Browse Products by Sector

Container ShippingContainer Equipment Assets

Ports and Terminals

Dry Bulk Shipping

Tanker Shipping

Gas Shipping

Specialised Shipping

Multimodal Transport

Logistics Management

Ship Operations and Management

Other popular areas

Browse subscriptions by Sector

Container ShippingPorts and Terminals

Dry Bulk Shipping

LPG Shipping

LNG Shipping

Crude Tanker Shipping

Product Tanker Shipping

Financial Advisory

Valuations

Drewry Financial Research Services Ltd is authorised by the UK Financial Conduct Authority (FCA).

Tanker market anxiously waits for Trump to show cards on Iran

May 12 is the deadline for the US to decide whether or not to waive sanctions on Iran as part of the 2015 nuclear deal which allowed Tehran to resume oil exports in exchange for curbs on its nuclear program. Although there are more questions than answers at this stage, the re-imposition of sanctions would cause a significant tightening of global oil supply-demand balance.

Although, US withdrawal from the deal looks almost certain, it will be difficult to convince the EU to join the renewed US sanctions. Similarly, countries such as China and India, which complied with the previous sanctions in 2012, are also unlikely to give full support to the possible sanctions on Iran. If the US withdraws unilaterally without the support of Europe, its impact would be diluted.

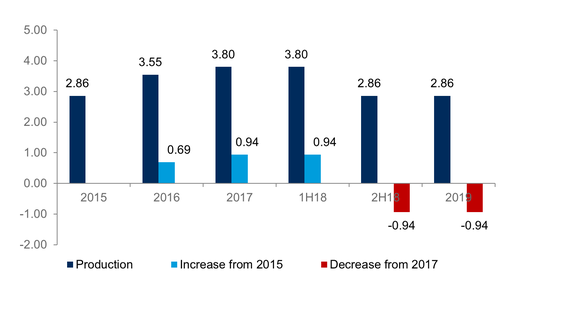

However, if we consider a situation similar to the 2012 sanctions, it will wipe-out all the gains of close to 1.0 mbpd in Iranian production which came after the nuclear deal. The potential impact on oil and tanker market this time around would be more severe, as the market is already very tight on account of firm demand, OPEC production cuts and declining Venezuelan output.

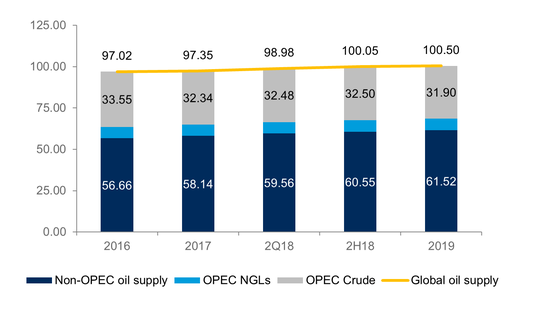

Although, non-OPEC production is surging with the rise in US production, the market will still be in tight supply over the next three quarters if OPEC keeps its production at March levels. Even in the absence of sanctions, the call on OPEC crude and stock change for the remainder of the year will be about 0.6 mbpd higher than OPEC’s March production levels of 31.8 mbpd not-withstanding the rising US-led non-OPEC production. In 2019 the situation should ease as further gains in US production will bring down the call on OPEC crude.

So, if Iranian output falls by 1.0 mbpd, it will be difficult to bridge potential shortages of close to 1.5 mbpd in the second half of 2018 and 0.9 mbpd in 2019 without OPEC’s support, as most of the non-OPEC producers are already pumping at full throttle.

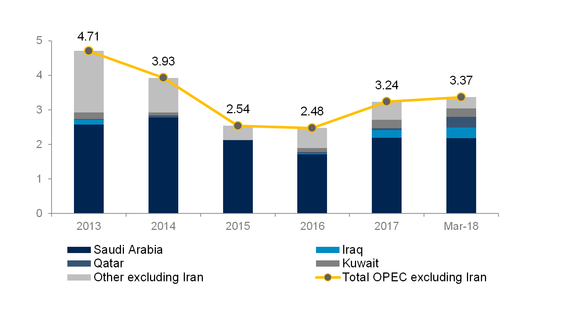

Theoretically OPEC producers (excluding Iran) have more than enough spare capacity (3.4 mbpd) to fill the possible void created by Iran sanctions. The majority of this spare capacity lies with Saudi Arabia and other Middle Eastern producers.

So if Middle Eastern OPEC producers ramp up production to fully compensate for any decline in Iranian supply, the sanctions will have no impact on oil trade and tanker demand as lower Iranian exports will be counterbalanced by higher exports from the other Middle Eastern producers.

However, if cartel doesn’t compensate fully for the possible Iranian production decline, the market will be in deep trouble, as the gap will have to be met by inventory drawdown, which in turn will curb trade by an equivalent volume.

In this scenario we could see a decline in seaborne crude oil trade close to 50 million tonnes (equivalent to 2.2% of 2017 trade). Or put another way, 15-20 VLCCs, could be without employment.

© Copyright 2024 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy