Browse Products by Sector

Container ShippingContainer Equipment Assets

Ports and Terminals

Dry Bulk Shipping

Tanker Shipping

Gas Shipping

Specialised Shipping

Multimodal Transport

Logistics Management

Ship Operations and Management

Other popular areas

Browse subscriptions by Sector

Container ShippingPorts and Terminals

Dry Bulk Shipping

LPG Shipping

LNG Shipping

Crude Tanker Shipping

Product Tanker Shipping

Financial Advisory

Valuations

Drewry Financial Research Services Ltd is authorised by the UK Financial Conduct Authority (FCA).

Will China’s surging imports shape the future of LNG shipping?

China is set to become the world’s second largest LNG importer, yet the immediate impact of this development on the LNG shipping market is likely to be muted.

China is promoting natural gas as an environment friendly energy source

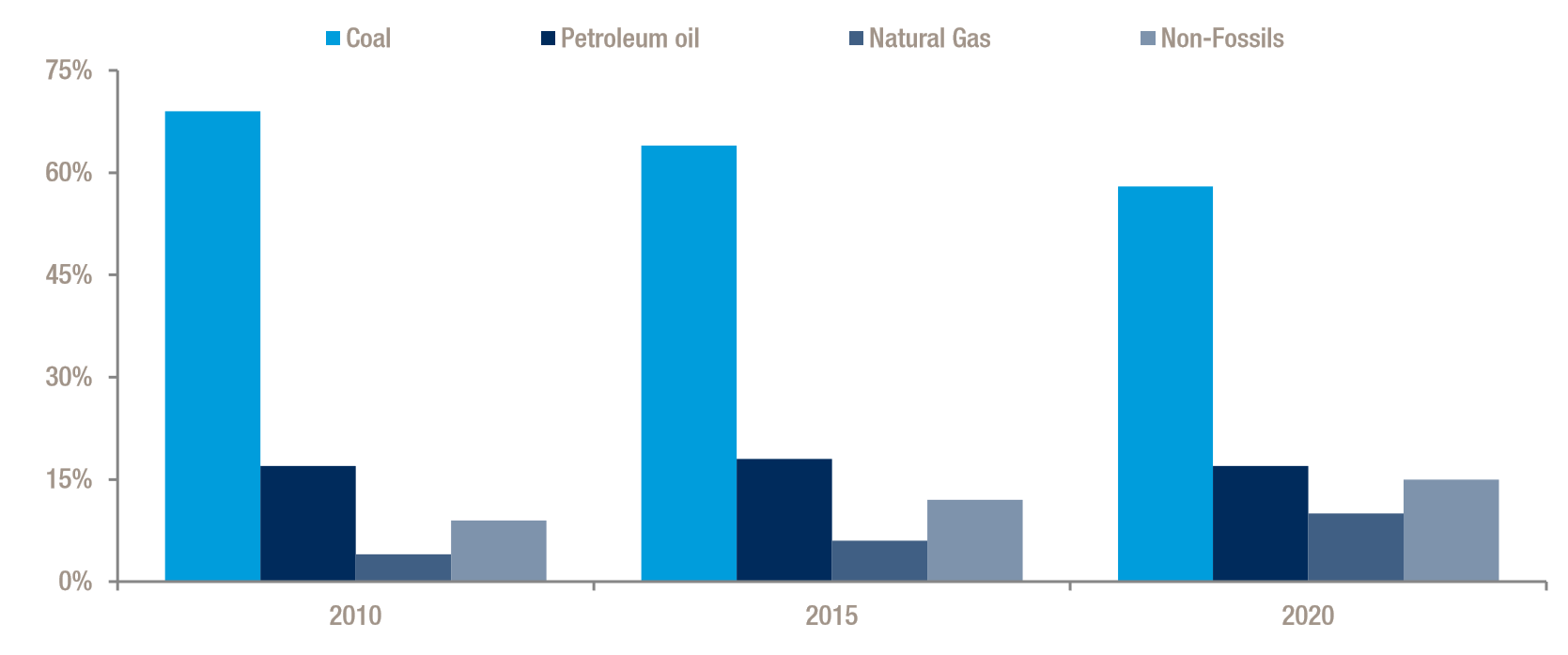

The Chinese government is rapidly replacing coal with natural gas to control pollution. China’s 13th five-year plan aims to reduce coal’s share in the overall energy mix from 64% in 2015 to 58% in 2020, while raising the use of gas from 6% to10% between 2015 and 2020. In order to reach this target, the country is implementing strict regulations on coal usage and in many northern Chinese cities the sale, transportation and burning of coal during this winter is now prohibited. The ban is expected to reduce the use of coal by 2 million tonnes, creating a potential demand of 1 million tonnes for LNG.

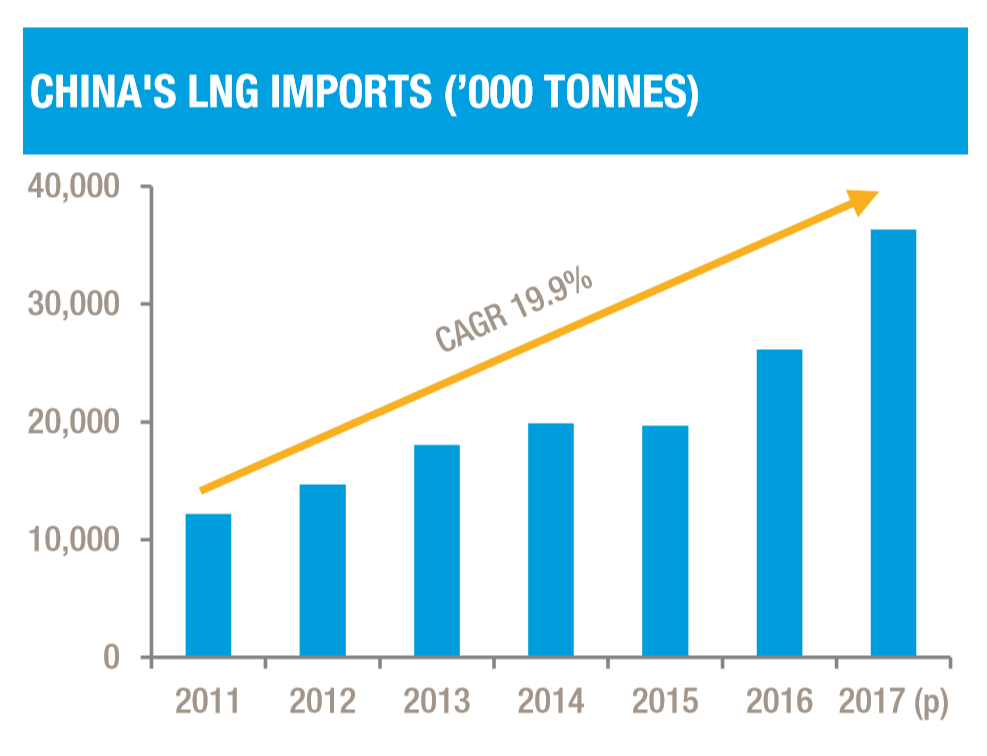

The effect of the regulation is also visible in the country’s import volumes. In third-quarter 2017, China imported about 9.7 million tonnes of LNG, 52% higher than the same period of 2016 and the highest year-on-year growth rate seen since 2009. By contrast the country’s coal imports declined by 2% over the same period.

China Energy Consumption Mix as per 13th 5-year plan

Source: China 13th 5-year plan

Will domestic gas production be sufficient to meet rising demand?

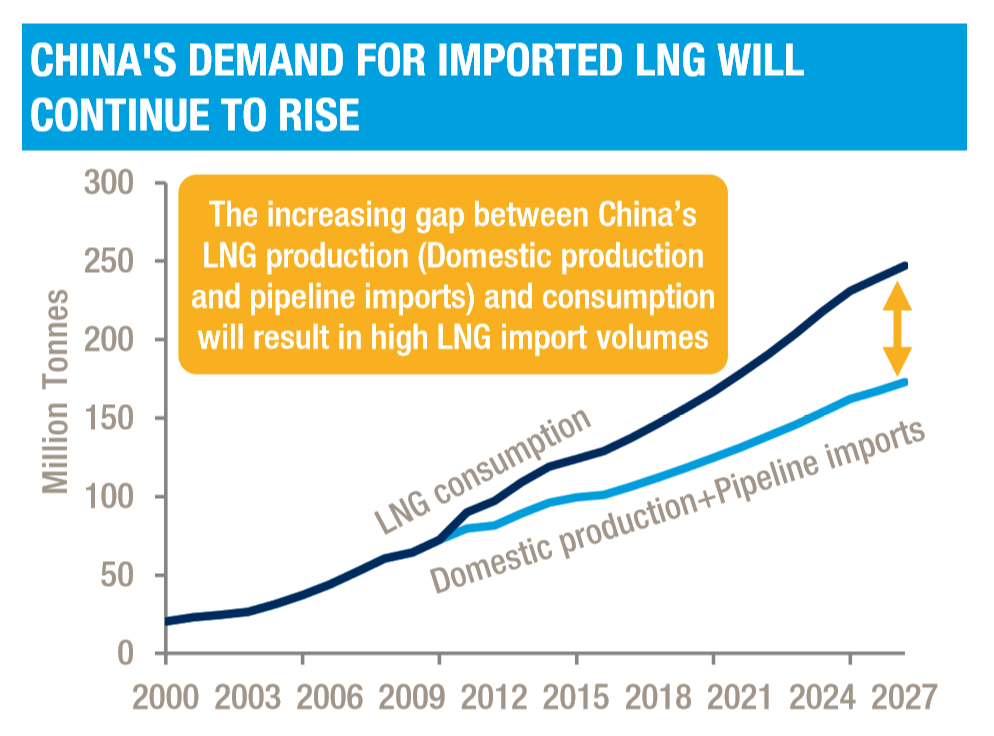

China’s gas consumption is expected to rise at a much higher pace than domestic production, resulting in growing LNG imports. According to the most recent World Energy Outlook (WEO) report the surge in China’s gas consumption will surpass domestic production and natural gas

pipeline imports, thereby creating demand for imported LNG. During the period 2018-2023, domestic production and pipeline imports are expected to increase by 6.8% per year, while the consumption is forecast to grow by 7.3% annually. Therefore, China’s LNG imports are likely to grow in the future, at rates in line with its contracted supply.

Source: Drewry Maritime Research

Source: Drewry Maritime Research

For the moment China’s contracted LNG import volumes will be sufficient to meet demand and therefore there is unlikely to any immediate bounce on vessel demand and spot rates. Indeed, ships for most of the 2018 contracted cargo volume of 27 million tonnes have already been fixed. This leaves about 5 million tonnes of LNG imports that will absorb spot market capacity – and depending on where the gas is sourced from – generate employment for some 8-10 LNG carriers.

But from 2022 onwards China’s gas demand will exceed the country’s contracted cargo volume and that in turn will create additional demand for LNG tonnage. Where the gas is sourced from will play a significant role in determining the exact demand for LNG ships. For example, the distance from Australia to China is less than 50%

of the distance from the US to China. Hence, if China decides to increase its share of US LNG imports, both tonne-mile demand and fleet utilisation will grow at a faster pace than if China imports the incremental LNG from Australia.

During 2022-2026, China will have an additional requirement for 55 million tonnes of LNG (as current contracted volume will fall short of the rising demand), with total imports in 2026 likely to be in the order of 22 million tonnes. If shipments from the US rose to account for 20% of these imports it would create additional employment for 60-70 LNG vessels, which is about 15% of the current fleet. At 40% of total imports, shipments of LNG from the US to China would create additional demand for about 80-85 LNG carriers. Hence, longer-term, Chinese LNG imports and the demand they create for LNG carrying capacity will be a major feature of the market.

Return to...

Related Content

© Copyright 2024 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy