New disruptions to supply chains in 2022 and how international shippers can respond

As we look ahead to 2022, should shippers prepare for a new round of disruptions? And what key issues should they think about as they finalise plans for the new year? In this year-end Logistics Executive Briefing, our supply chain consultants identify four potential, new disruptions and provide guidance on what are likely to be priority issues shippers should consider and prepare for in 2022.

For logistics managers working for international shippers/Beneficial Cargo Owners, 2021 was a year many would like to forget. The pressures have been relentless, with logistics teams suffering sustained and systemic global supply chain disruption, record port congestion, cargo delays, chronic capacity shortages, breaches or near breaches of shipping contract commitments - and ocean freight rates surging to extreme levels.

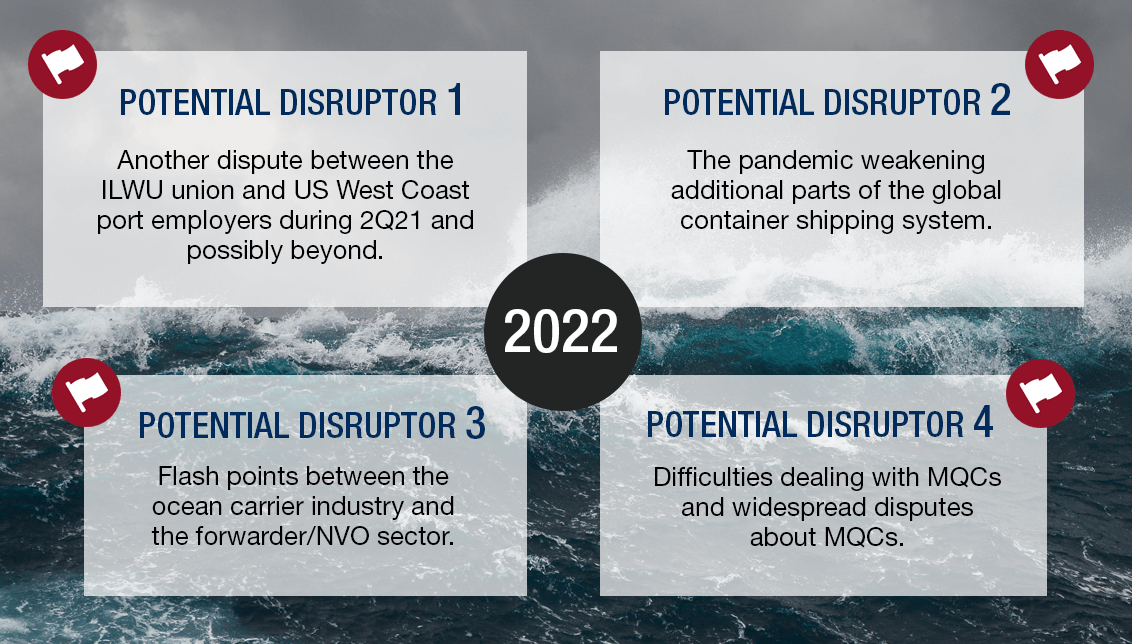

Unfortunately, fundamental structural market vulnerabilities remain and for international shippers, where supply chain resilience is a particular concern, we highlight four potential new disruptors, shipping and logistics management teams should anticipate and prepare for in 2022:

1. Another dispute between the ILWU union and US West Coast port employers

This will push back by weeks or even months the reduction of acute congestion at US West Coast ports, with ripple effects on global carriers’ schedules and on the ability of ports in Asia to handle unscheduled ships or bunched ships affected by problems in the US. For BCOs with long memories of earlier disputes, now is the time to look at alternative routes to avoid US West Coast ports.

2. The pandemic weakening additional parts of the global container shipping system

China’s current zero tolerance Covid policy makes it particularly likely to shut down, and without prior warning, more/secondary ports, more barge operations and more feeder operations as new cases arise. Further lockdown measures in other countries, triggered by new Covid variants or pandemic waves also cannot be ruled out. We fear the prospect of more dislocations / lack of coordinated asset deployment between ocean carriers and rail carriers in the US, in particular. Seafarer shortages and travel restrictions may worsen with any surge in cases, which will further limit the number of sailings shipping companies are able to make to meet demand.

3. Flash points between the ocean carrier industry and the forwarder/NVO sector

We are starting to see that some ocean carriers are withdrawing from NVOCC relationships and others are making it difficult for NVOs to offer carrier-like fixed contract rates to shippers under preferential “named account” terms agreed in advance with the ocean carriers. The role and the pricing strategy of the NVOCC have shifted since the start of the pandemic with many now offering shorter term and varying premium rate levels in return for finding space and equipment solutions. Medium and small NVOs may find themselves excluded from BCOs’ large annual ocean tenders.

4. Difficulties dealing with MQCs and widespread disputes about MQCs

More BCOs - even the largest ones - will have to accept the new reality of the market: you cannot expect to ship 10 containers one week, 50 containers the next week, and hope to get 100% capacity for both weekly volumes. Carriers and NVOs are already telling BCOs that their capacity in 2022 will be the contractual Minimum Quantity Commitment per annum “divided by 52”. Whilst capacity constraints have been a common theme for 2021, for 2022 we see the additional constraint that full or high payment of the freight will be due when the capacity is not used by the shipper. Drewry believes that the majority of BCOs are not organized to manage this type of volume commitment. Disputes will spread in 2022 about how to deal with excess volume above weekly MQC and deficit volume below weekly MQC and about associated penalty clauses.

The detailed management of contractual MQCs is a new issue to many shippers, but it can be addressed. Drewry has been working with BCOs, particularly US importers, on how to build plans to move closer to the objective of even volumes or at least early communication of weekly volumes. Techniques to improve in this area include more aligned operations of consolidation and ‘origin management’ in Asia with suppliers.

Which brings us to the topic of what shippers should think about next year.

The 2021 logistics nightmare forced shippers to react to problems and to try to divert to alternative ports of entry, alternative transport modes (air freight, cross-border rail) and alternative providers (‘premium rate’ NVOs), but it left no time to pause and plan ahead. Again, here’s our shortlist of required plans, based on recent and current consultancy work carried out for shipper customers:

- Optimise internal operations: improved MQC management processes, volume forecasting and communication of your forecasts to carriers etc... Control better what you can control.

- A contingency plan for ILWU-related US West Coast port shutdowns to mitigate the next port crisis.

- Prioritise working with the right logistics providers and strengthen your carrier relationships and your business continuity plans, to help deal with ‘the next crisis’ as and when it happens. (We hate to sound pessimistic, but it really is a question of when, not if.)

- Review your supply chain and your transport networks to reduce your exposure to the super-inflated container shipping costs, which are expected to remain so in the medium term.

Many members of the Drewry Benchmarking Club, a user group of over 120 multinational shippers, are already looking at sourcing products from alternative locations to avoid spending 5-digit freight rates per container from Asia to the West. Others are looking at using warehouses closer to the port instead of using those located near congested rail hubs such as Chicago, for example.

The new state of unreliable, very expensive international shipping calls into question the previous assumptions behind low-cost production in Asia serving distant markets at minimal logistics costs. While it was rarely the case until 2019, the ‘freight’ component of the total landed cost now makes a real difference for many types of products. Also important in 2022 will be the need for many BCOs to raise product prices to reflect higher transport costs, while proactively benchmarking (higher) transport costs to ensure their rates remain competitive - and regularly talking to merchandising, sourcing and production colleagues to update them on the reality of those much higher ocean transport costs.

So, plenty to think about ahead of 2022.

To discuss any of the topics above or to learn about the consultancy work of Drewry Supply Chain Advisors, please contact supplychains@drewry.co.uk

Related Content

Key Contacts

© Copyright 2026 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy