Maritime Financial Research

Certified Vessel Valuations

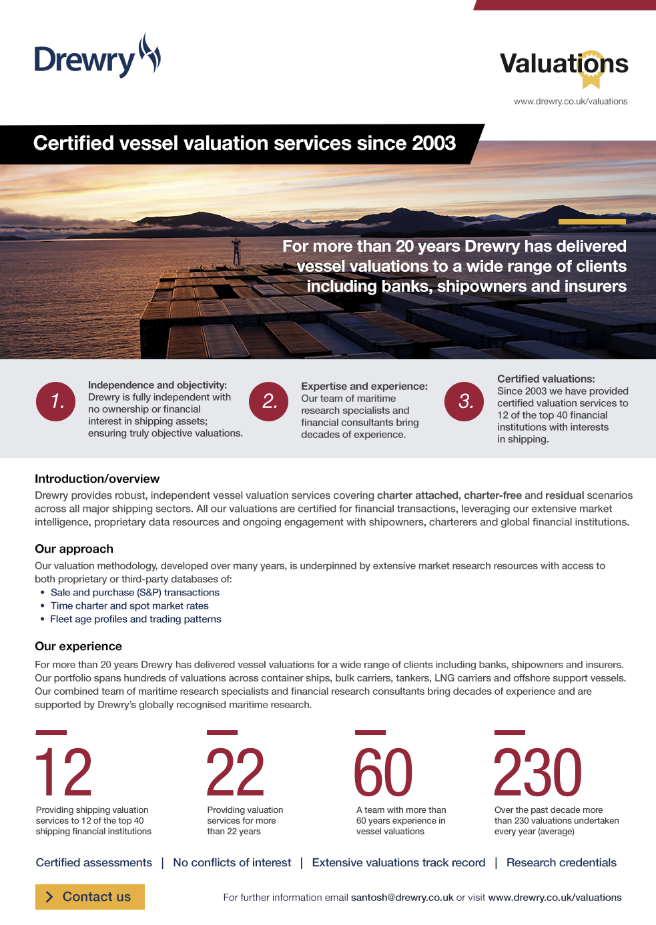

Since 2003 Drewry has provided robust, independent vessel valuation services covering charter attached, charter-free and residual scenarios across all major shipping sectors. All our valuations are certified for financial transactions and leverage our extensive market intelligence and proprietary data resources.

Why Drewry

Certified valuation services: Drewry valuations are certified to use in financial transactions (ship financing, audited financial statements, sale and purchase transactions etc).

Independence and objectivity: Drewry is fully independent with no ownership or financial interest in shipping assets - ensuring truly objective valuations with no conflicts of interest.

Expertise and experience: Our team of maritime research specialists and financial consultants bring decades of experience and are backed by Drewry’s industry-leading maritime research capabilities and resources.

Track record: More than 20 year’s providing valuation services to 12 of the top 40 shipping financial institutions.

Comprehensive research services: Drewry publishes in-depth research reports across all the main shipping sectors.

Our Approach

Our valuation methodology, developed over many years, is underpinned by extensive market research resources with access to both proprietary or third-party databases of:

- Sale and purchase (S&P) transactions

- Time charter and spot market rates

- Fleet age profiles and trading patterns

Experience

For more than 20 years Drewry has delivered vessel valuations for a wide range of clients including banks, shipowners and insurers. Our portfolio spans hundreds of valuations across container ships, bulk carriers, tankers, LNG carriers and offshore support vessels.

Our combined team of maritime research specialists and financial research consultants bring decades of experience and are supported by Drewry’s globally recognised maritime research.

12

Providing shipping valuation services to 12 of the top 40 shipping financial institutions.

22

Providing valuation services for more than 22 years.

60

A team with more than 60 years experience in vessel valuations.

230

Over the past decade more than 230 valuations undertaken every year (average).

Market understanding

Investment analysis based on a clear understanding of the market at both an industry and sector level.Quality insights

Our analysts have access to one of the most up-to-date, comprehensive and reliable sources of market insight.© Copyright 2025 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy