Maritime Research

Container Freight Rate Insight (Annual Subscription)

Online Service

October 2025

Spot freight rate benchmarks

First introduced in 2006, Container Freight Rate Insight (CFRI) is an indispensable online reference for importers, exporters, freight forwarders and other stakeholders requiring up-to-date, independently researched ocean freight rates and freight cost benchmarks.

CFRI provides a popular and robust reference for index-linked contracts, which we can also help you develop.

API access is available for a fixed annual fee of $12,350 covering; service access, set-up and configuration.

We are the only global provider of verified, like-for-like spot freight rate benchmarks drawing on a stable panel of buyers (~30 freight forwarders and NVOCCs) who provide us with their ’buy rates’ and market data which we use to calculate monthly and weekly average spot rates, ensuring continuity and comparability of data.

Spot rate forecasting service: Subscribers can also request customised monthly or bi-monthly spot rate forecasts against their priority port pairs (price on application).

Enquire about spot rate forecasts

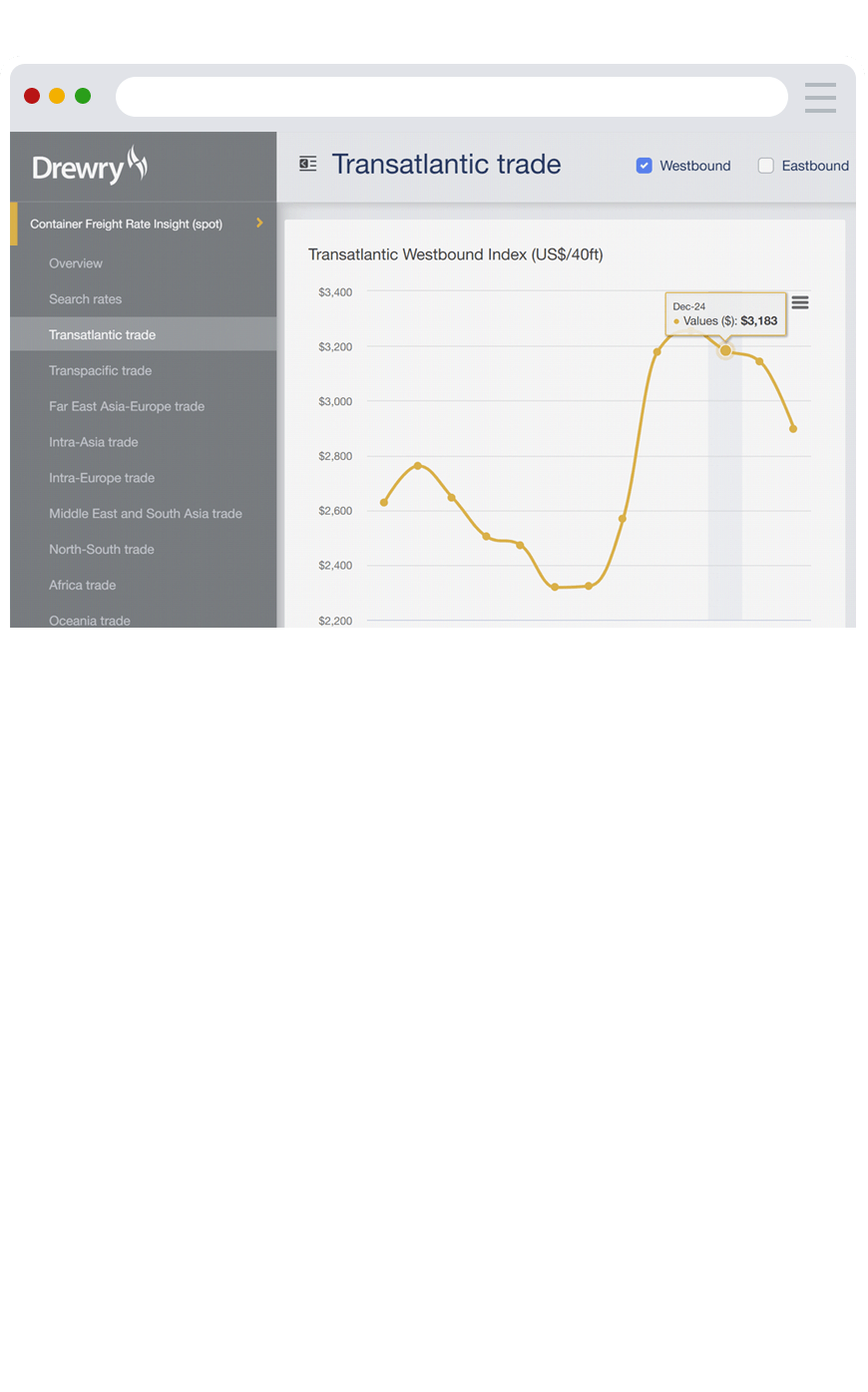

CFRI accessed via Drewry’s new Container Freight Portal

Demonstration of Search Rates functionality

As well as the CFRI spot market freight rate service we also offer:

- A confidential contract ocean freight rate service, Drewry Benchmarking Club, exclusively for shippers/BCOs

- An exclusive, custom spot rate forecasting service for subscribers on their priority port pairs (price on application)

Membership of Benchmarking Club includes a subscription to the CFRI service.

More Information

- Online access via Drewry Container Freight Portal

- Includes a monthly ’Insight’ (PDF report) providing analysis of key developments across the main trades

- 6,700 global port pairs updated monthly (over 2,450 fortnightly)

- Download rate history available for the most popular port pairs

- Access to an exclusive Spot Rate forecasting service - price on application

- Single site licence, annual subscription terms (NB global licence and/or API access available on request)

- Includes complimentary access to the following Drewry rate indices and trackers: World Container Index, Intra-Asia Container Index, Contract Rate Index, Cancelled Sailings Tracker, Global Port Throughput Index and LSFO Bunker Price Tracker

- Download brochure

For shippers/BCOs

Container Freight Rate Insight provides rates that are actually being paid by other companies on the route(s) that interest you. While Drewry cannot disclose specific company information for confidentiality reasons, the aggregated pricing information provides a benchmark against which you can test the success of your freight rate negotiations. It also provides informed analysis and a view on the short-term outlook for freight rates.

- Check trends in freight levels to determine contract renewal risks and benefits.

- Identify cost-saving opportunities, negotiate better rates and make informed selections of shipping partners

- Leverage our monthly commentary and analysis to guide your final budgeting and sourcing decisions on the main industry price drivers like supply/demand, BAFs etc

NB The service does not include container freight rate forecasts, but we are able to provide these to you as a custom service contact a member of our team for further information.

For freight forwarders and NVOCCs

The Container Freight Rate Insight will help in your rate negotiations with clients by providing independent evidence of changes (increases or decreases) in market rates.

- Giving transparency to mid-market spot market levels

- Showing freight rate market trends to customers

- Indexing contracts on a back-to-back basis with carriers and shippers

- Authentic independent evidence with Drewry’s name and reputation

For carriers

The Container Freight Rate Insight will enable you to benchmark your average rates on specific port pairs against the latest forwarder market buy rates. These cover business with multiple carriers and are indicative of average market rates. The benchmarks will also provide market intelligence for studies on new routes or ports.

For financial and market analysts

Both individual freight rate benchmarks and aggregate indexes published in the Container Freight Rate Insight will enable you to promptly track changes in the market and identify key pricing indicators of the health of the container shipping industry.

- Ability to gauge market strength

- Trend analysis assists interpretation of current company profitability since the last financial report

- Drewry commentary, analysis and news provides expert informed opinion on industry drivers

NB: There is a 100 port pair download limit per month to access historical freight rates. Current freight rate data (covering the most recent four-month period) can be downloaded in batches of 750 port pairs.

Join Drewry's Benchmarking Club and compare your contract rates with your peers

Drewry Benchmarking Club goes beyond the spot market intelligence provided by Container Freight Rate Insight (CFRI) and allows members to confidentially benchmark their contract shipping costs against their peers – based on genuine, shipper-only, buy-rate comparisons.

Contact us at supplychains@drewry.co.uk for a demonstration of the new platform to learn more about the various membership packages available. Please note, membership is exclusive to shippers only (importers and exporters) - not freight forwarders, carriers or NVOCCs.

News

Events

LNG market outlook briefing

TOC Asia

© Copyright 2025 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy