Maritime Research

Drewry Benchmarking Club

Customised Real Time Benchmarking

January 2026

All-inclusive ocean freight rate package

Are you securing the most competitive contract container freight rates?

Drewry’s Benchmarking Club is an exclusive, shipper-only, closed user group, allowing members to confidentially benchmark their contract shipping costs against their peers – based on genuine, shipper-only, buy rate comparisons.

Club members benefit from access to all our ocean freight cost benchmarking services - Benchmarking Club, Container Freight Rate Insight and World Container Index via Container Freight Portal.

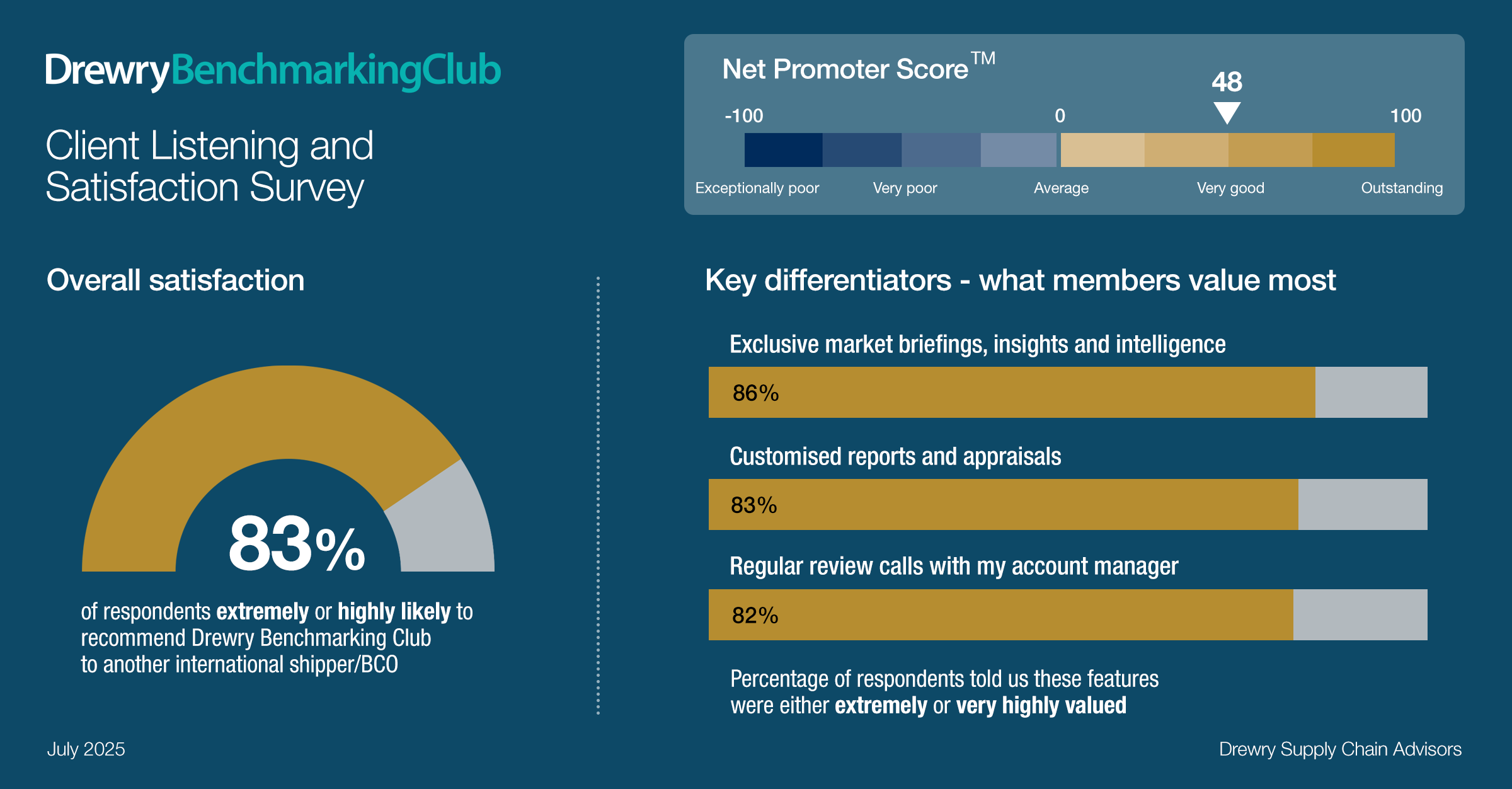

Jul 25: Benchmarking Club: Client satisfaction and loyalty

Why Benchmarking Club?

-

Visibility of prevailing market rates (contract and spot)

-

Have confidence in your negotiating position with carriers

-

Understand short, medium and long term market development

-

Market forecasts to inform planning and indices to understand trends

-

IMO Sulphur regulation intelligence

-

Understand latest procurement best practices to maximise efficiencies and achieve optimum results

-

Provide robust proof-points to gain internal stakeholder approval

- Monthly reports and tailored briefing for your organisation

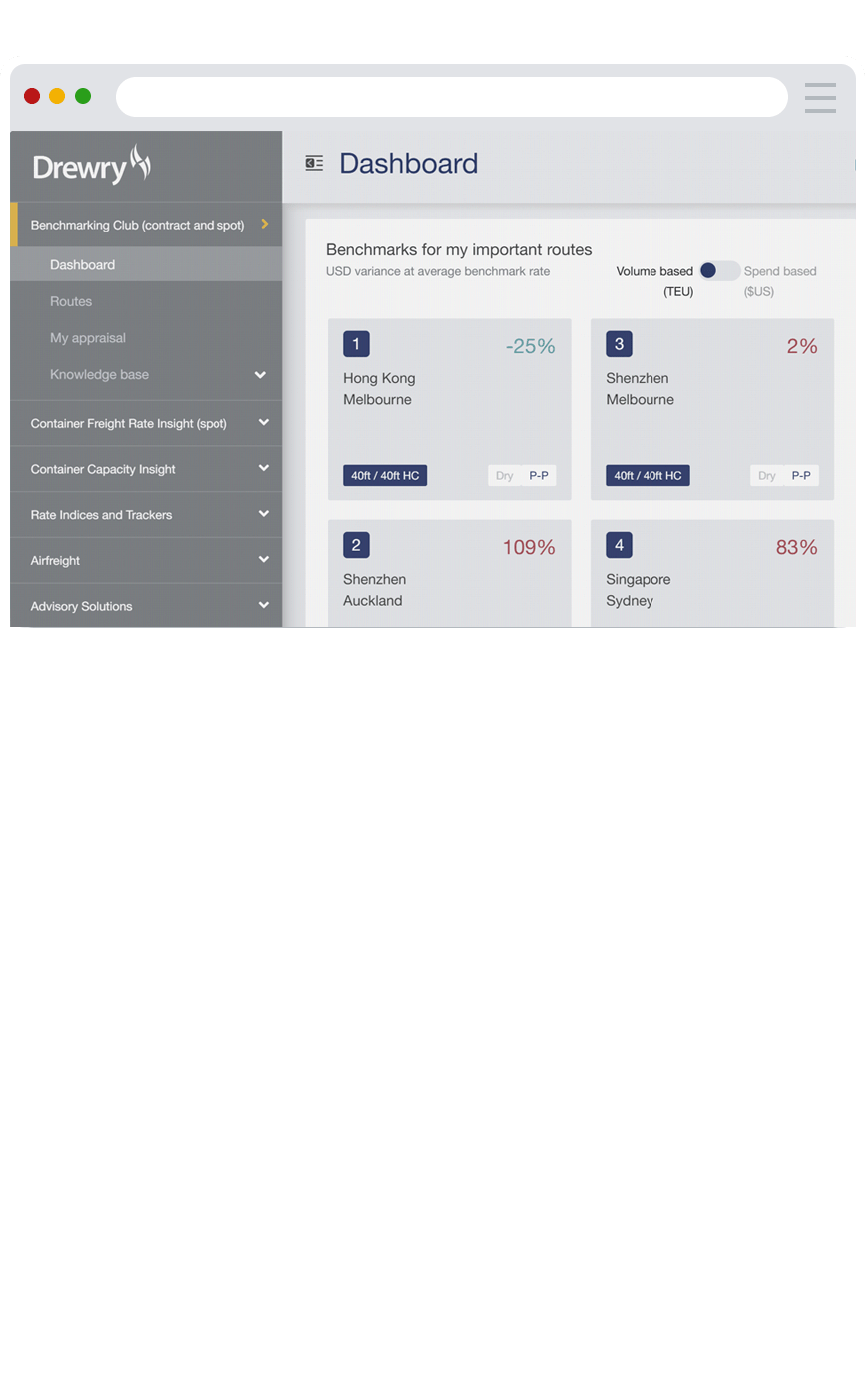

Container Freight Portal: fully-integrated freight cost benchmarking platform

- Overall spend analysis and comparisons

- Detailed analysis by route

- Historic rate evaluation

- Indices and forecasts

- Rate inconsistencies

- Includes spot rates against 6,700 routes - Container Freight Rate Insight

- Container Capacity Insight is an optional supplementary service

- Request spot rate forecasts against your priority routes

- Request API access to Drewry spot rate data

Includes access to the following Drewry indices:

- World Container Index, Intra-Asia Container Index, Airfreight Index, Port Throughput Indices, Cancelled Sailings and LSFO Bunker Price Tracker

More Information

Fast facts...

- Membership is exclusive to shippers - importers and exporters only (not freight forwarders, carriers or NVOCCs)

- Access all our spot and contract ocean freight rate services via a single online platform (Dry and Reefer Benchmarking options available)

- Participants benefit from access to freight rate forecasts, key route indices and exclusive market outlook and best practice briefings

- Benchmarking contract BAFs every quarter on the major East/West routes

- Bespoke quarterly appraisal reports tailored to your routes

Solutions for shippers

Events

LNG market outlook briefing

Argus Biomass Asia Conference

Fruit Logistica 2026

© Copyright 2026 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy