Browse Products by Sector

Container ShippingContainer Equipment Assets

Ports and Terminals

Dry Bulk Shipping

Tanker Shipping

Gas Shipping

Specialised Shipping

Multimodal Transport

Logistics Management

Ship Operations and Management

Other popular areas

Browse subscriptions by Sector

Container ShippingPorts and Terminals

Dry Bulk Shipping

LPG Shipping

LNG Shipping

Crude Tanker Shipping

Product Tanker Shipping

Financial Advisory

Valuations

Drewry Financial Research Services Ltd is authorised by the UK Financial Conduct Authority (FCA).

5 key ocean freight procurement considerations in a falling market

With world inflation widely anticipated to reach 8.8% in the closing weeks of 2022, senior executives within global manufacturers and retailers will be eagerly awaiting ocean transport savings as reports of plummeting containerised freight rates continue to make headline news. With Drewry’s composite World Container Index down a remarkable 75% year-on-year, such an expectation is understandable, however, as is so often the case, the devil is in the detail; while rates on Asian export retail-driven routes may have fallen by up to 85%, driven by utilisation figures below 80%, back haul trade lanes have seen only modest single digit falls with Transatlantic headhaul rates remaining stubbornly above the $7,000USD / 40ft mark.

Much as it started, the unwinding of the extreme global freight rate inflation of the pandemic period will be staggered, as easing congestion, cancelled loops and new vessel arrivals see capacity cascade across trade routes. And as the 2023 bid season approaches for many global shippers, negotiations will require a revised ocean freight procurement strategy.

Below we explore five decision-making dilemmas many procurement and logistics operations teams will find themselves grappling with over the coming weeks:

1. Should we move away from year-long contracts?

Many businesses remain undecided here, understandably concerned about locking-in rates only for the market to deteriorate further. With a significant number of contracts recently being renegotiated mid-term - either at the instigation of carriers looking for additional volume or by shippers unable to support the current delta between spot and contract rates - some are questioning the value of their long-term agreements.

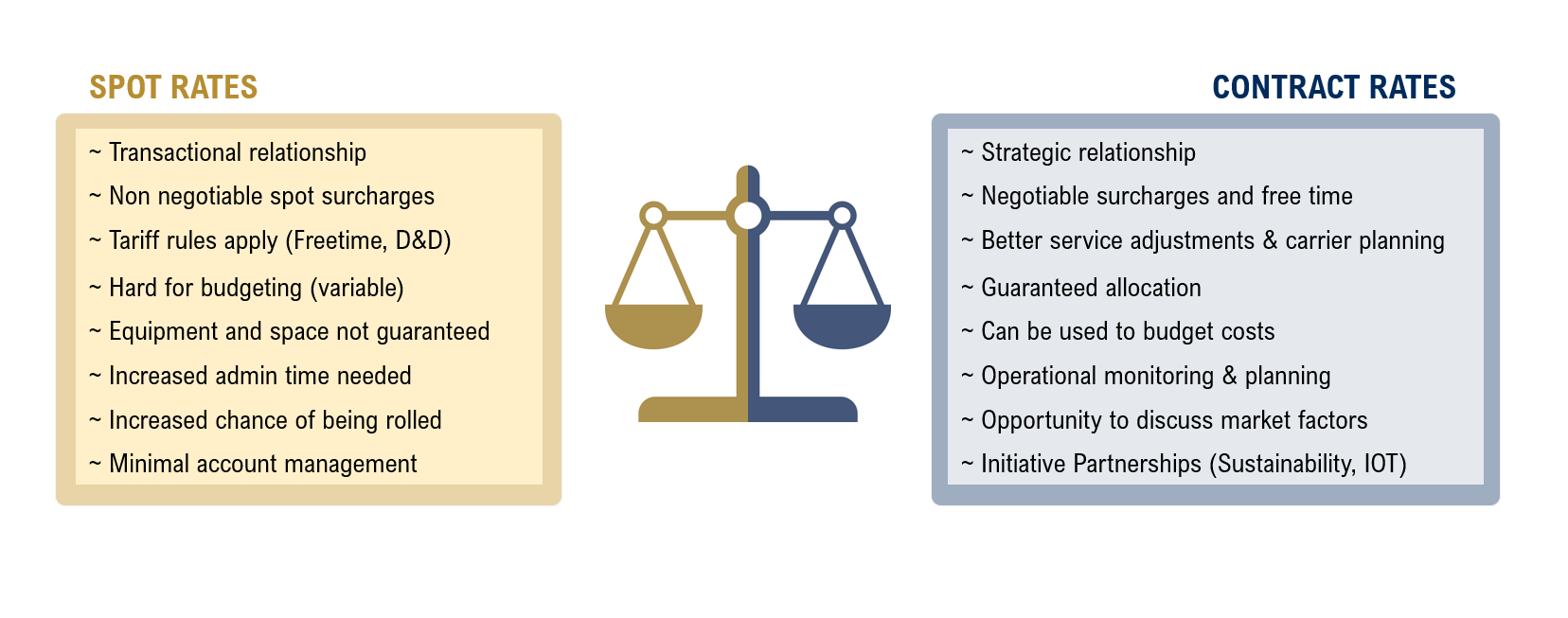

Some shippers with contracts expiring in line with calendar year have already opted for short term extensions, hoping to renegotiate more favourable terms. Other, typically smaller shippers, have moved to the spot market, feeling no loyalty to carriers and forwarders who largely abandoned their contracts in 2021 and left them exposed to premium and priority rates. Notwithstanding the obvious commercial imperative, most shippers are driven by more than straightforward base ocean freight cost. For shippers with more complex supply chains or customer obligations who seek more predictable annual freight budgets, Drewry still recommends fostering long term supplier relationships underwritten by contracts with at least one-year durations. Over the long-term, such agreements typically deliver not only a significant freight cost benefit, but also better payment terms, free time conditions and operational efficiencies.

2. Should we reduce our MQC?

The 16% fall in September East-West headhaul volumes compared with August, due to both high inventory levels and low consumer demand, was a primary trigger for the recent collapse in freight rates. With the vessel order book currently standing at 2.5 million TEU for 2023, the rise in capacity for 2023 may be clear but the outlook for global demand remains much more uncertain. In such circumstances many shippers will be cautious about Minimum Quantity Commitments (MQCs), feeling unclear about their own demand predictions, while remaining confident that market capacity will there should they need it.

“In such circumstances many shippers will be cautious about Minimum Quantity Commitments (MQCs), feeling unclear about their own demand predictions, while remaining confident that market capacity will there should they need it.”

3. How do we set bid target rates in a collapsing market?

The goal posts are moving fast, shippers are struggling to set target rates with initial offers from carriers often being significantly undercut by prevailing rates in the spot market. Drewry recommend that shippers set target rates based on at least 3 of the following valid data points: the underlying break-even, ‘cost per container’ of service providers, the current spot market, recently negotiated average contract market rates (from shipper benchmarking groups such as Drewry’s Benchmarking Club) and pre-pandemic rates. All can help support decision making at times of volatility.

4. Should we reduce our service provider pool?

There is little doubt that relationships between shipper and carriers/forwarders have been strained over the past year, with many shippers having to widen their service provider pool in a bid to secure the capacity required. In the current more buyer-friendly market, Drewry now recommend shippers review and consolidate their service provider pool, focusing on quality rather than quantity; reinforced by a robust Quarterly Business Review process with clearly defined and measurable KPIs. In a market where cost reductions seem inevitable, primacy should be given to providers that demonstrate they are both able and willing to improve performance from the dismal 30% service reliability seen over the past 2 years.

5. Should we move to an index linked contract?

Indexing is always a popular topic amongst shippers in a falling market and this year the buzz seems to be around the 'trigger clause', with shippers seeking the right to reopen discussions if the gap between spot and contract rates reaches a critical point. The reality today is that if supply and demand fundamentals remain sufficiently weak for such a gulf to materialise between long term agreements and spot conditions, carriers have to be open to renegotiate without the need for such a trigger mechanism. If the desire to build mutual relationships for the long term is genuine, a robust index linked policy can provide value to both sides, allowing focus to fall on operational improvement, rather than a constant discussion on price. Such a policy requires careful planning and preparation and an understanding that common ground exists between parties.

Ocean freight and carrier management services from Drewry

Is your organisation best placed to meet the challenges of today’s market and prepared for the future?

Extreme freight rate volatility, unpredictable lead times and poor service levels have exposed significant weaknesses in conventional bid and carrier management strategies in the last two years. A new approach is now needed which gives ocean freight logistics teams a better understanding of the market and fosters long term supplier relationships that improve service continuity and cost predictability.

Contact one of our ocean freight management and cost benchmarking experts to find out more.

Related Content

Key Contacts

© Copyright 2024 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy