Browse Products by Sector

Container ShippingContainer Equipment Assets

Ports and Terminals

Dry Bulk Shipping

Tanker Shipping

Gas Shipping

Specialised Shipping

Multimodal Transport

Logistics Management

Ship Operations and Management

Other popular areas

Browse subscriptions by Sector

Container ShippingPorts and Terminals

Dry Bulk Shipping

LPG Shipping

LNG Shipping

Crude Tanker Shipping

Product Tanker Shipping

Financial Advisory

Valuations

Drewry Financial Research Services Ltd is authorised by the UK Financial Conduct Authority (FCA).

Increasing scrap imports to India – a new hope for Handies

Fast-growing demand for ferrous scrap in India is engaging Handysize vessels on long-haul routes. India imported 6.4 million tonnes of scrap in 2016, of which 5.5 million tonnes was ferrous scrap. A third of total imports came from Europe and a fifth from the US, which has driven Handysize tonnemile demand.

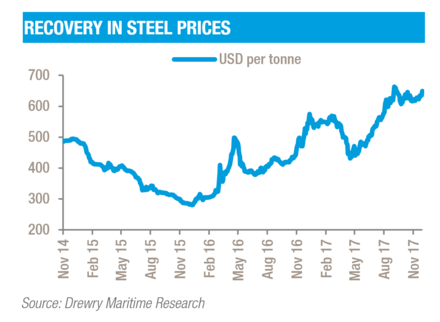

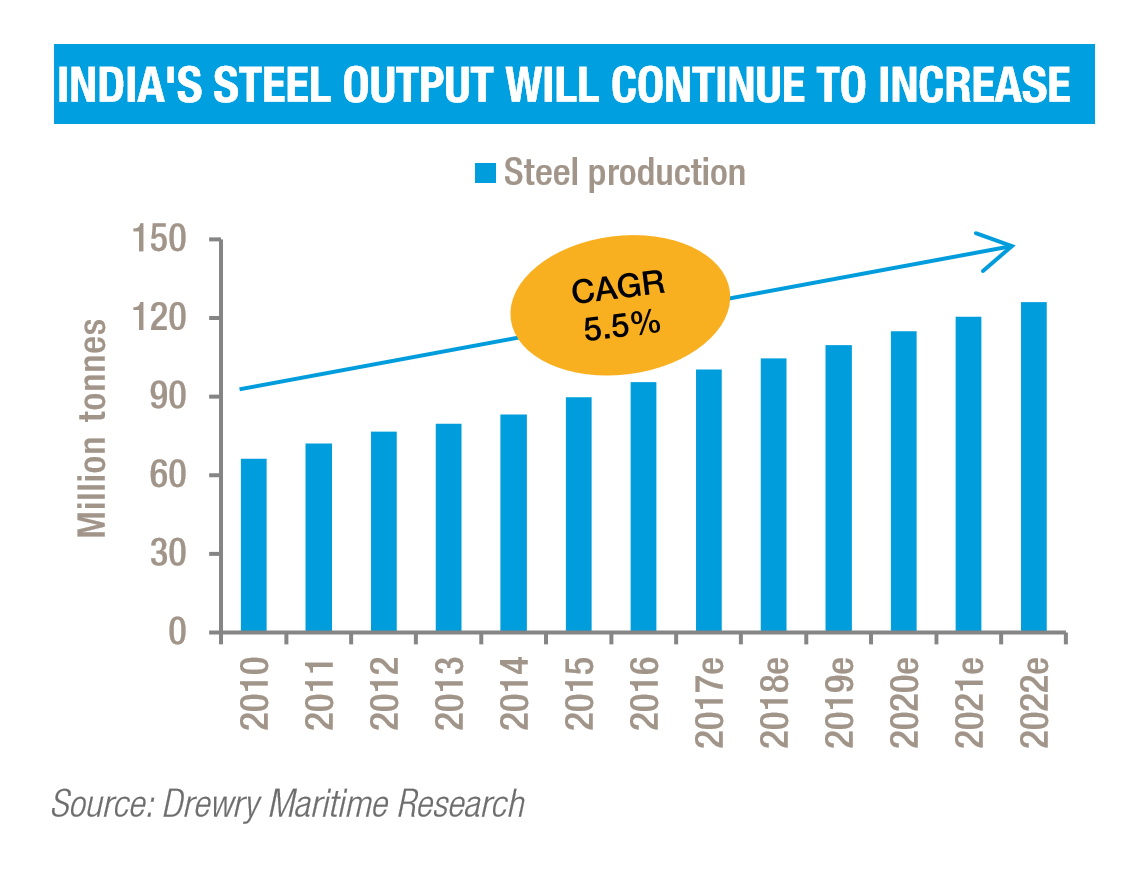

Steel production in India rose by more than 6% annually between 2010 and 2017. We expect steel production to continue trending upwards on the back of the government’s infrastructure push, which is creating more demand for crude steel. Moreover, a rebound in international steel prices has also encouraged steel producers to increase output. This will result in higher imports of ferrous scrap - which can be recycled into crude steel.

Given the expected increase steel demand, the Indian government has been under pressure to make ferrous scrap more affordable. We expect the government to do away with the current import duty of 2.5% on ferrous scrap amid growing pressure from domestic steel producers.

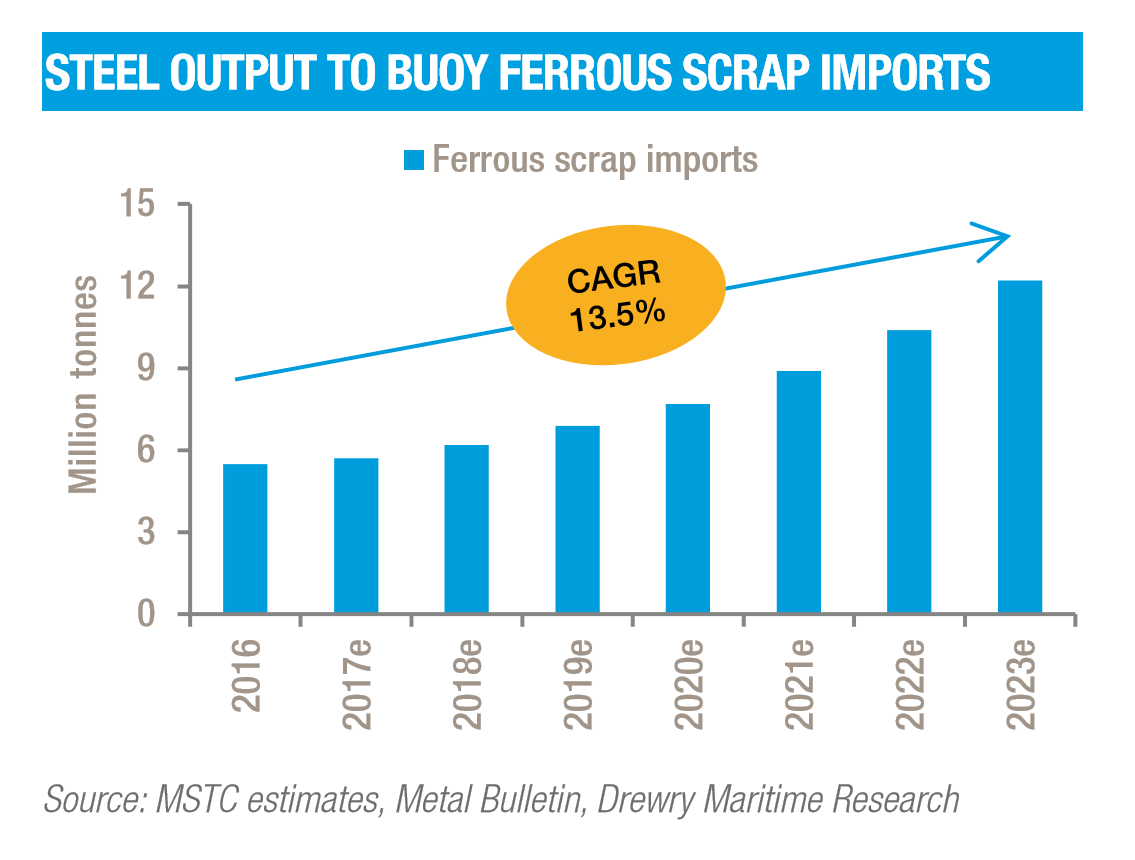

The Indian government’s export regulator, MSTC, forecasts a growing shortfall between local supplies of ferrous scrap and domestic requirements. From the current level of 5.5 million tonnes per year, it is forecast to rise to 12 million tonnes per annum by 2023. To meet the shortfall, India will continue to rely on imports of ferrous scrap from locations such as Europe and the US.

Impact on shipping

Rising imports should benefit the Handysize segment because of the long-haul nature of the trades. For example, the sailing distance between New Orleans and Vizag is 12,400 nautical miles, while it is 7,500 nautical miles between the UK and Vizag. A one-way trip from the US to India takes 42 days, and from the UK to India, it is 26 days. An increase of 6.5 million tonnes of cargo movement between the US/Europe and India will generate an annual demand of 200 plus Handysize ships by 2023, good news indeed for the sector.

A more detailed analysis on the potential impact of rising seaborne trade in ferrous scrap on the Handysize market will be contained in the January 2018 edition of Drewry’s Dry Bulk Forecaster.

Return to...

Related Content

Key Contacts

© Copyright 2024 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy