Browse Services by Sector

Container ShippingContainer Equipment Assets

Ports and Terminals

Dry Bulk Shipping

Tanker Shipping

Gas Shipping

Specialised Shipping

Airfreight Transport

Logistics Management

Ship Operations and Management

Other popular areas

Browse subscriptions by Sector

Container ShippingPorts and Terminals

Dry Bulk Shipping

LPG Shipping

LNG Shipping

Crude Tanker Shipping

Product Tanker Shipping

Financial Advisory

Valuations

Drewry Financial Research Services Ltd is authorised by the UK Financial Conduct Authority (FCA).

Supply Chain Advisors

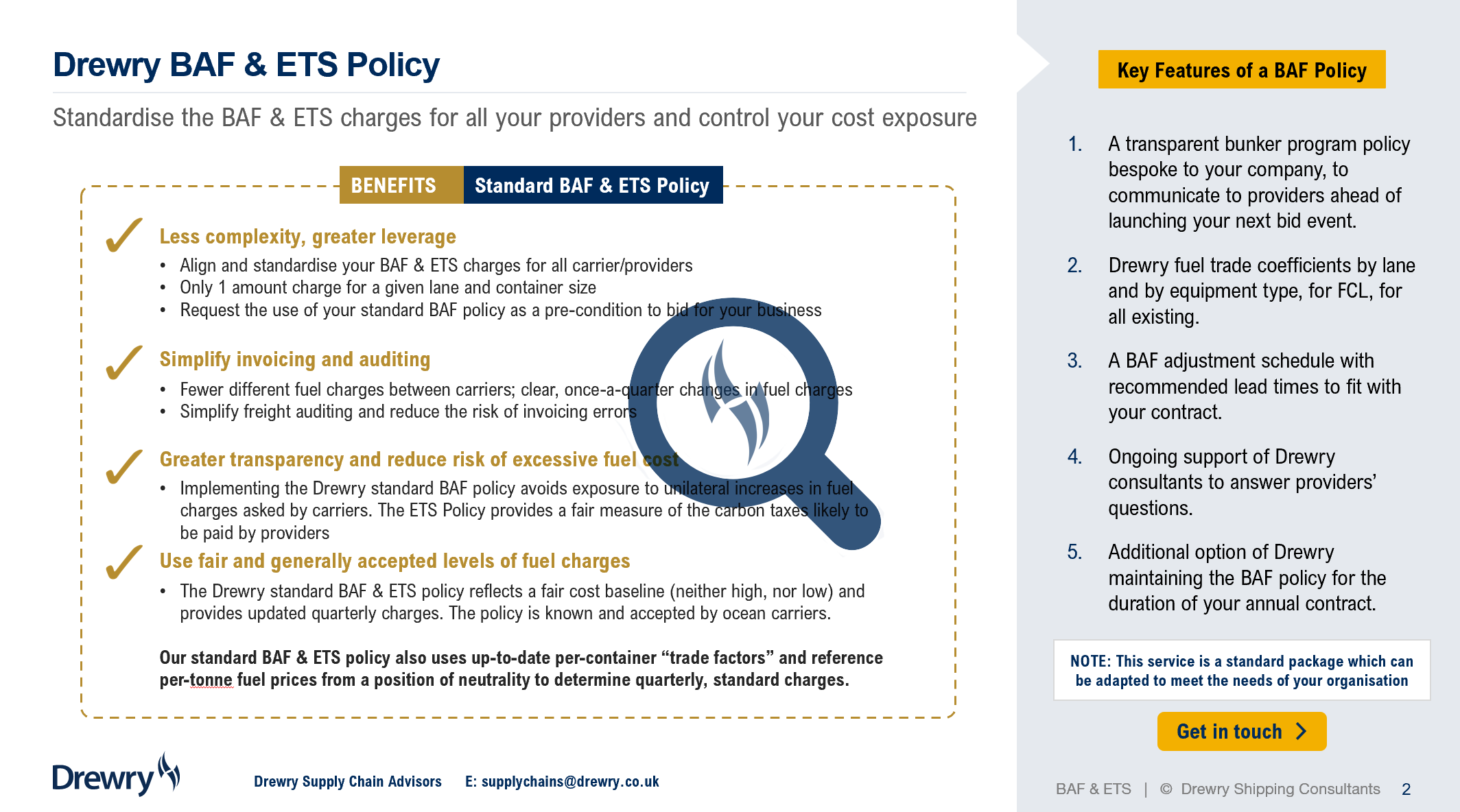

BAF and ETS Policy Support

Implement our Standard BAF Policy, align the BAF charges for all your providers and reduce your exposure to excessive unilateral increases in fuel charges.

The Drewry Standard BAF Policy is an industry standard, accepted by the major ocean carriers and adopted by a number of our BCO clients. We provide a clear policy document, tailored to your company and its trade lanes, which can be communicated to your Logistic Service Providers (LSPs) prior to bid.

Adopting our standard BAF Policy provides a number of benefits:

- Less complexity through standardisation

- Simplify invoicing and auditing

- Greater transparency, reduced risk of excessive charges

- Incorporates our latest view on new fuel types

- Use your BAF policy as a pre-condition to bid for your business

To be confident of achieving the best terms of service and value for money - as well as access to latest market data - shippers need a robust plan that covers the entire process from initial pre-RFQ to bunker program implementation, review and monitoring.

Transportation Manager, Global Paper and Pulp Manufacturer

Senior Procurement Manager, International Provider of Office Supplies

Browse recent projects

Working with 3 of the top 10 global retailers (National Retail Federation)

Access to an exclusive ocean freight cost benchmarking club comparing costs on over 14 million teu of freight

The first to publish benchmark container spot market freight rates back in 2006.

© Copyright 2025 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy