Browse Services by Sector

Container ShippingContainer Equipment Assets

Ports and Terminals

Dry Bulk Shipping

Tanker Shipping

Gas Shipping

Specialised Shipping

Airfreight Transport

Logistics Management

Ship Operations and Management

Other popular areas

Browse subscriptions by Sector

Container ShippingPorts and Terminals

Dry Bulk Shipping

LPG Shipping

LNG Shipping

Crude Tanker Shipping

Product Tanker Shipping

Financial Advisory

Valuations

Drewry Financial Research Services Ltd is authorised by the UK Financial Conduct Authority (FCA).

Maritime Advisors

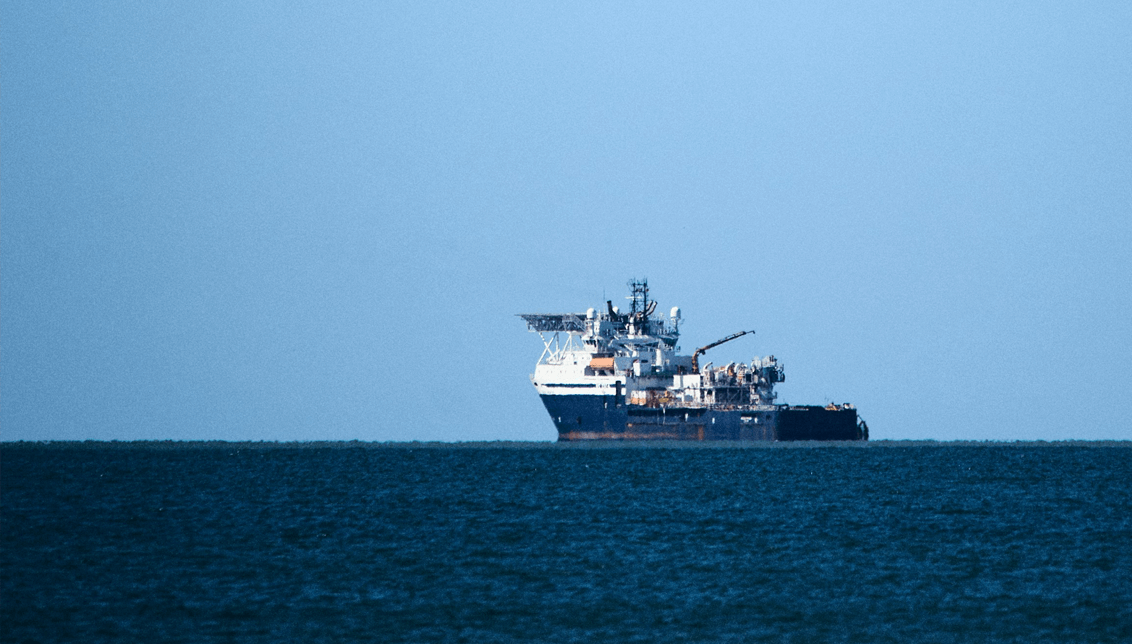

Offshore

Drewry covers the global offshore markets from offices in London, Delhi, Singapore and Shanghai. Over the years Drewry has built a strong reputation in the offshore sector; working for Offshore support & Drilling companies, Financial institutions and Port O&M operators in assignments ranging from market analysis, financial modelling and analysis, to operational assessment, technical and commercial due diligence.

Drewry provides expert advice covering the full spectrum of the commercial and technical aspects of the Offshore Drilling & Support Vessel Industry. We can assist clients in developing their overall business strategies and key investment decisions. Including the identification of opportunities; review of the competitive environment; and potential risks, mitigation, revenue and profitability analysis.

Our services include:

- Market analysis – characteristics and dynamics of offshore markets, customer, key trends, cabotage laws and competitor analysis

- Offshore Support base studies – independent assessment of Oil & Gas markets, Exploration & Production activities in the region, Hinterland and Logistics aspects analysis

- Techno-commercial due diligence – independent assessment of the market, EHS review, shipbuilding contracts review, asset and charter market review

- Investment and divestment appraisals – market entry strategies and vessel acquisition review for offshore support sector

- Market studies and forecasting – projecting offshore vessel demand, identifying trends, opportunities, and challenges

- Asset Valuation – charter free and discounted cash flow valuations for offshore tugs and support vessels

4

$4bn: The combined value of container shipping industry investments we have advised on since 2018

20

$20bn: The value of financing projects we have provided commercial due diligence advice for in port M&A since 2014.

34

The number of countries in which our Maritime Advisors have completed assignments since 2015.

428

The number of port assignments our advisory team have been involved in over the past 10 years.

Our Experience

Case studies

Browse our catalogue of past project case studies to better understand the work we do for our clients and the value we bring.Delivering results

Our understanding comes from working closely with our clients, always giving them a balanced, commercial perspective to achieve the right result.

Due diligence for an Egyptian OSV Operator

Due diligence of offshore operator in India

Offshore Due diligence project

© Copyright 2025 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy