Browse Services by Sector

Container ShippingContainer Equipment Assets

Ports and Terminals

Dry Bulk Shipping

Tanker Shipping

Gas Shipping

Specialised Shipping

Airfreight Transport

Logistics Management

Ship Operations and Management

Other popular areas

Browse subscriptions by Sector

Container ShippingPorts and Terminals

Dry Bulk Shipping

LPG Shipping

LNG Shipping

Crude Tanker Shipping

Product Tanker Shipping

Financial Advisory

Valuations

Drewry Financial Research Services Ltd is authorised by the UK Financial Conduct Authority (FCA).

Airfreight growth continues in August 2024, led by e-commerce and regional demand

We are now including regular airfreight market updates, such as the article below, in our Logistics Executive Briefing thought leadership series. Drewry recently launched Airfreight Insight an all-new online subscription service, via Container Freight Portal - which as well as monthly E-W airfreight rate benchmarks on 127 airport-to-airport lanes, includes our unique Airfreight vs Maritime Price Multiplier.

Sustained recovery in air cargo set to continue

August 2024 was another strong month for the airfreight industry, with global air cargo traffic increasing by 11.4% year-over-year, measured in cargo tonne-kilometres (CTK) and marking the ninth consecutive month of double-digit expansion. To underscore the sustained recovery in the air cargo sector, the International Air Transport Association (IATA) highlighted robust international traffic, which rose by 12.4% compared to August 2023, with airlines based in Asia-Pacific and Latin American regions leading the expansion.

E-commerce and sea-air conversion traffic remain key growth drivers

Since the last quarter of 2023, e-commerce exports from China, together with sea-air traffic routed through South Asia and Middle Eastern transit hubs, have been key drivers of global airfreight growth with both areas making-up for softer industrial activity, which has historically been a primary contributor to air cargo demand. The continued boom in e-commerce and mixed-modal logistics reflects shifting consumer behaviour and preferences which have boosted demand for airfreight services as businesses strive to meet delivery expectations.

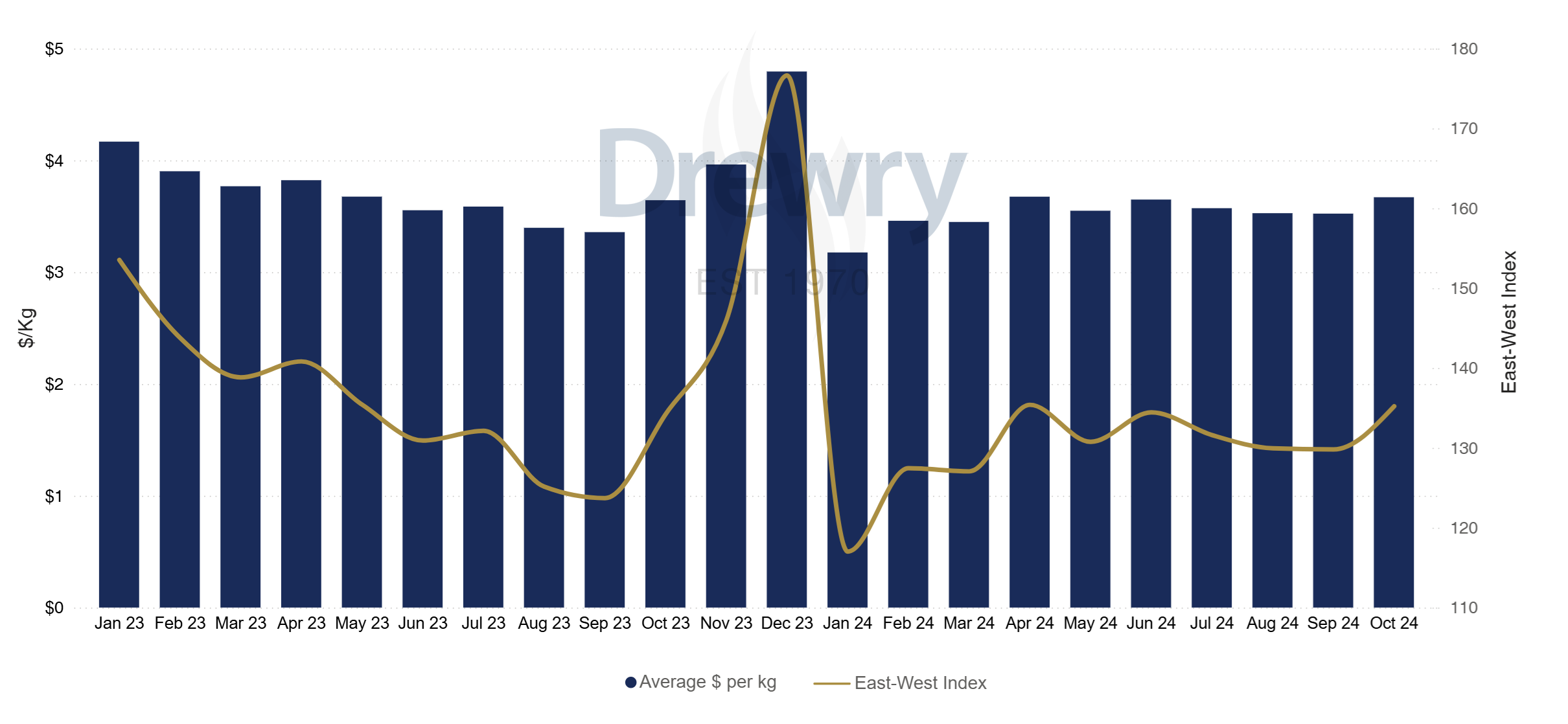

Drewry East-West Airfreight price index (May 2014=100)

Note: This index is a weighted average of all-in airfreight 'buy-rates' paid by forwarders to airlines for standard service airport-to-airport airfreight services of 1,000 kg+ on 28 major East-West routes. Rates are expressed in US$/kg and include 3 components: the base rate, the fuel surcharge and the security surcharge. They exclude door delivery costs.

Source: Drewry Maritime Research, Airfreight Insight

Capacity growth continues to lag traffic adding pressure to supply chains

While airfreight traffic surged, global airfreight capacity, measured in available cargo tonne-kilometres (ACTK), expanded by only 6.2% year-over-year in August, which marked the sixth consecutive month in which capacity growth has lagged demand, creating supply pressures. Regionally, airlines based in Africa (10.5%), Europe (9.4%), and Asia-Pacific (8.6%) led capacity expansion. However, even with increased cargo space on passenger flights – up 10.9% in August – belly capacity growth was at its slowest pace since the second quarter of 2021. Meanwhile, dedicated freighter capacity increased more modestly by 5.0% year-over-year.

In October, the strike at US East Coast and Gulf ports had raised concerns of damaging disruptions to supply chains, however, its relatively swift resolution helped stabilise pricing and alleviate uncertainty within international airfreight markets, easing pressure on logistics providers.

Improvements in load factor and yield signal market strength

Global air cargo load factors have also improved, reaching 44.0% in August, a 2.0 percentage-point increase from the previous year. European airlines led the industry with a 50.1% cargo load factor, while Asia-Pacific and Middle East carriers followed closely with load factors of 46.6% and 44.5%, respectively. This increase in load factors has contributed to a steady rise in industry-wide cargo yields, which has been a consistent trend throughout 2024, reflecting healthy demand.

Outlook for Q4 2024 and beyond: E-commerce and capacity constraints

The outlook for air cargo remains optimistic, with growth expected to continue into the fourth quarter of 2024. However, capacity constraints from the leading aerospace manufacturers could create bottlenecks should demand continue to grow into 2025. Proposed legislation in several developed economies, however, could impact e-commerce growth, potentially affecting airfreight demand in the long term. Nevertheless, relatively high container shipping rates compared to airfreight costs continue to make air cargo an attractive option for shippers during the current peak season.

Conclusion

In summary, August 2024 was another strong month for the airfreight industry, propelled by sustained e-commerce growth and the strategic use of sea-air conversion routes. While capacity constraints and potential regulatory changes could present challenges in the longer term, current trends indicate a positive trajectory for air cargo with demand remaining strong across global markets.

About Airfreight Insight

Published through Container Freight Portal, Drewry’s integrated freight cost benchmarking and logistics management platform, our all-new Airfreight Insight provides detailed monthly analysis of the global airfreight markets.

Key areas covered:

- Monthly market summary and key ocean vs airfreight comparisons

- Global airfreight capacity, demand and load factors by major route

- Drewry’s unique Airfreight vs Maritime Price Multiplier

- Airfreight insight risk indicators (market disruptor and impact)

- East-West airfreight rate benchmarks on 127 airport-to-airport lanes

- East-West airfreight rate indices

- Purchasing Managers Index indicators

- Airline traffic

- Airport traffic

- Jet fuel price and semi-conductors data

- East-West air freight indices

- Z score of service providers’ financial risk

Online service (delivered through Container Freight Portal) and monthly PDF reports

Related Content

Key Contacts

Container Industry Statistics

World Container Index

East-West composite ($/40ft)Bunker Prices

Rotterdam ($/tonne)Global Port Throughput

Jan 2019 = 100

Idle Capacity

('000 teu)© Copyright 2025 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy