White Paper: Global supply chain disruption - Visibility solutions

Improving maritime supply chain reliability is once again a top corporate issue, but stretched logistics teams often struggle to build a business case for adoption of shipment visibility systems.

In February’s Logistics Executive Briefing, Drewry analysed how, with carrier performance targets continuously being missed, shippers are re-evaluating processes to keep tabs on carrier service delivery and accountability.

This month, Drewry provides insight into the business needs specifications and recommended steps to plan, prepare and implement visibility programmes in a white paper.

Why are BCOs and shippers struggling with visibility?

Stuck between structurally worsening market conditions and increasing customer expectations, BCOs find themselves forced to innovate. The need to know where their cargo is and when it will reach its destination has evolved from being a luxury feature for high-end supply chains to a necessity item in each BCO’s competitive toolkit. Yet our industry research shows that more than 80% of importers do not have full tracking of their shipments.

Clearly, no two supply chains are the same and there are no low-cost, “one-size-fits-all” visibility solutions. Hence every visibility project has to be mapped out, starting with a blank piece of paper. Furthermore, already stretched logistics teams often do not have internal project resources or time to run analyses and feasibility studies on shipment visibility systems, or the digital skills to bring such projects to fruition. And there is a lack of industry standards and joined-up processes and systems capable of covering all transport modes.

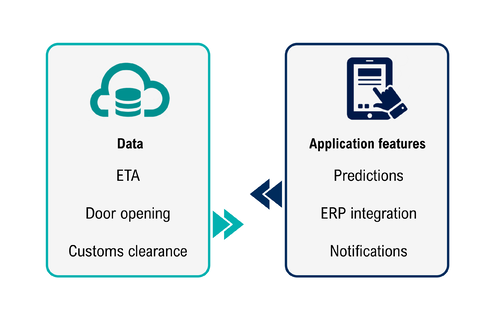

Turning data into actions

The shipment visibility technology sector finds itself already in a period of rapid growth and product diversification, which offers distinct opportunities for BCOs. Drewry will continue to review the visibility sector and work with BCOs to identify appropriate solutions and plan their implementation. Key to the value of visibility programme is the understanding and mapping of key data sets to real business applications, see figure below.

Experienced logistics executives need not be reminded that high-impact disruptions in global transport are becoming increasingly frequent, whether caused by pandemics, port strikes, accidents or natural disasters.

Increasingly Drewry is being asked by global BCOs to help establish requirements, develop the business case and manage the vendor procurement and implementation of their visibility programmes.

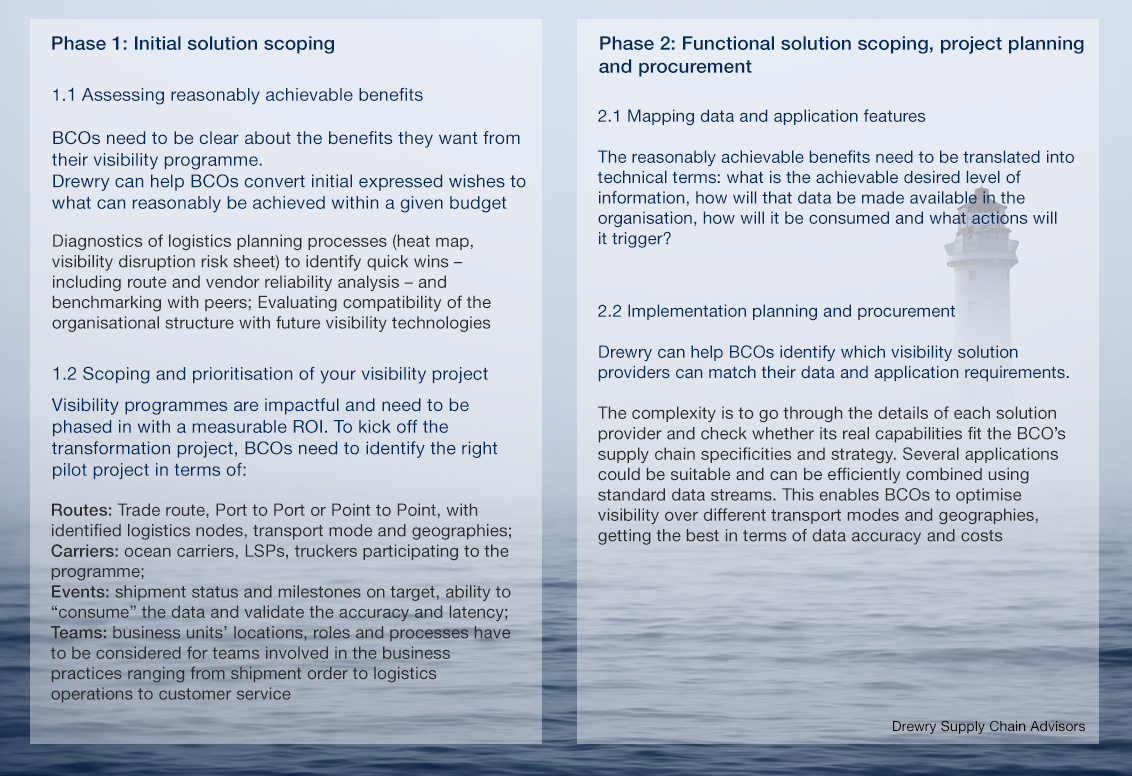

We recommend a two-phased approach:

Drewry's 2-phase approach to visibility projects

Major criteria to assess the right technology

Advanced visibility systems are increasingly a “must have” for any global business. Shipment milestone updates by batch Electronic Data Interchange from your ocean carriers or forwarders provide a sound foundation for logistics planning, vendor allocation and management. However, to remain resilient in the most challenging times, real time visibility and predictive ETA capabilities are pre-requisites.

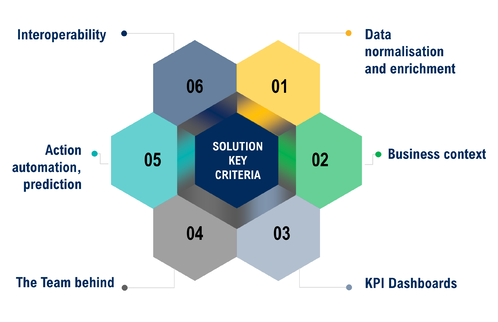

Drewry recommends the following dimensions are taken into consideration as part of any visibility solution.

Figure 2: Discovery: Key dimensions to evaluating visibility solutions

Ask one of our ocean freight experts...

If you are interested in a one-to-one conversation with a member of our supply chain advisory team or would like to learn more about how we are helping organisations like yours plan, prepare and implement visibility programmes, contact us at supplychains@drewry.co.uk.

Look out for further thought leadership on maritime supply chain inefficiency and disruption published in our Logistics Executive Briefings channel in the coming weeks.

Related Content

Key Contacts

Container Industry Statistics

World Container Index

East-West composite ($/40ft)Bunker Prices

Rotterdam ($/tonne)Global Port Throughput

Jan 2019 = 100

Idle Capacity

('000 teu)© Copyright 2026 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy