Supply Chain Advisors

Key Contacts

World Container Index - 08 Jan

For many years, World Container Index (WCI) has been the go-to, independent, global reference for index-linked contracts. If your organisation is considering index-linked contracts or requires regional visibility/coverage beyond the eight trade lanes provided below, contact our ocean freight cost benchmarking team.

Drewry’s World Container Index increased 16% to $2,557 per 40ft container this week.

Drewry World Container Index (US$/40ft)

Not displaying? Click here to open this chart in a new window

WCI Trade Routes from Shanghai (US$/40ft)

Source: Drewry World Container Index, Drewry Supply Chain Advisors

Not displaying? Click here to open this chart in a new window

Our detailed assessment for Thursday, 08 Jan 2026

- The Drewry World Container Index (WCI) increased 16% to $2,557 per 40ft container, mainly due to rate hikes on Transpacific and Asia–Europe trade routes.

- Spot rates on the Shanghai–Genoa increased 13% to $3,885 per 40ft container, while those on Shanghai–Rotterdam rose 10% to $2,840 per 40ft container. This upward momentum was driven by higher FAK rates implemented by carriers.

- Spot rates on Shanghai to Los Angeles surged 26% to $3,132 per 40ft container and those from Shanghai to New York increased 20% to $3,957 per 40ft container.

- Capacity rose 7–10% MoM on both Asia–North American routes and 5–7% on Asia–North Europe/Med routes in January, while anecdotal information points to soft volumes from Asia to the US, indicating that these large increases appear opportunistic and unlikely to last long.

Spot freight rates by major route

Our assessment across eight major East-West trades

Source: Drewry Supply Chain Advisors

Not displaying? Click here to display this table in a new window

WCI Methodology

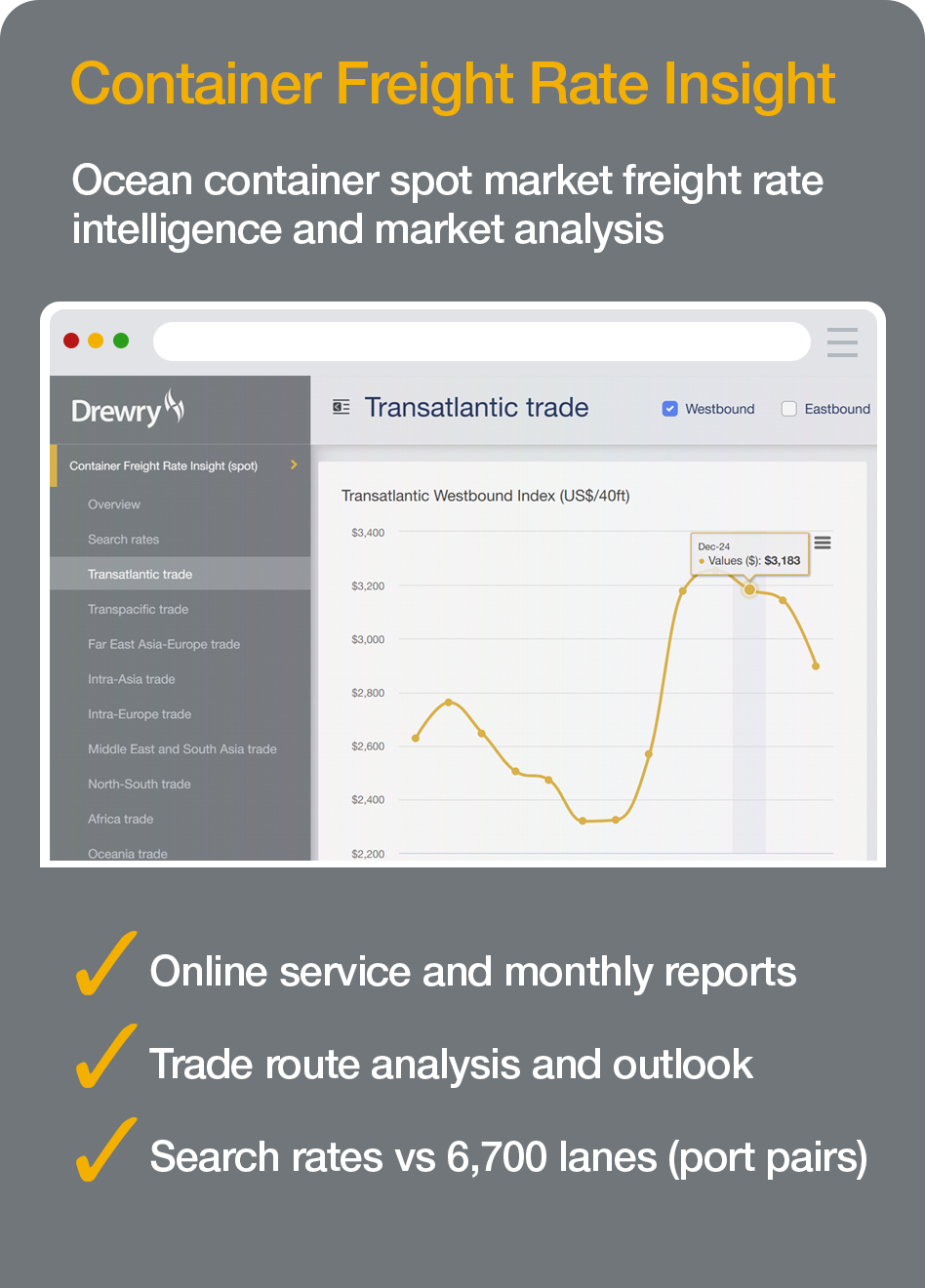

Ocean spot market freight rates against 6,700 global port pairs

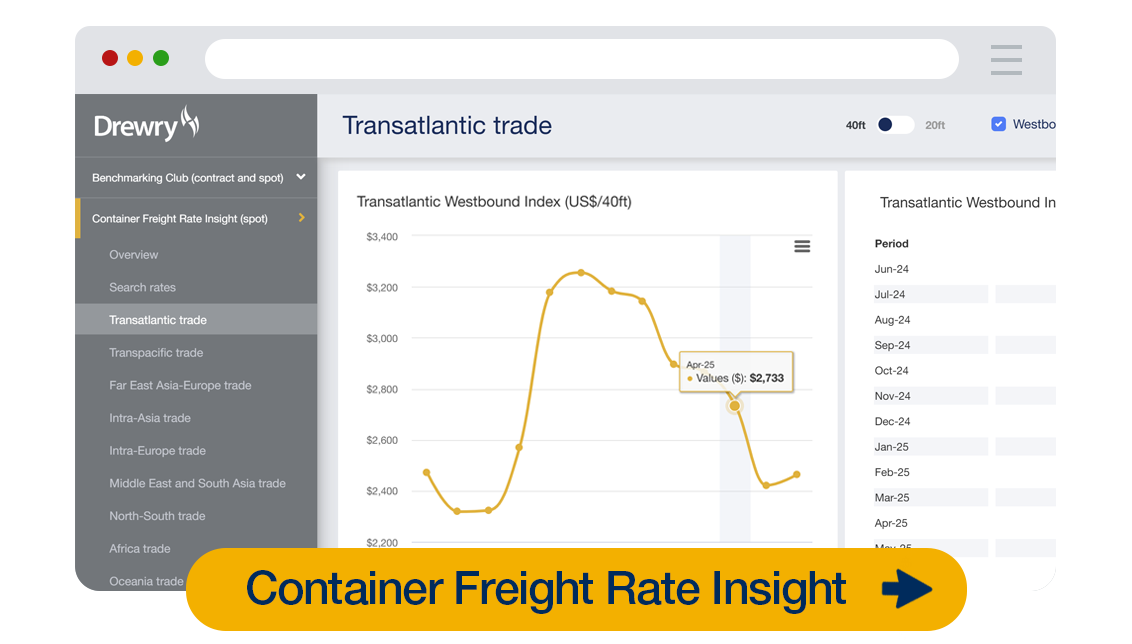

If you need spot market container freight rate information on other routes to those above, find out more about our Container Freight Rate Insight (CFRI) online service, which covers 6,700 global port pairs updated monthly (2,450 updated fortnightly).

Container Freight Portal: Request a demonstration

Related Research

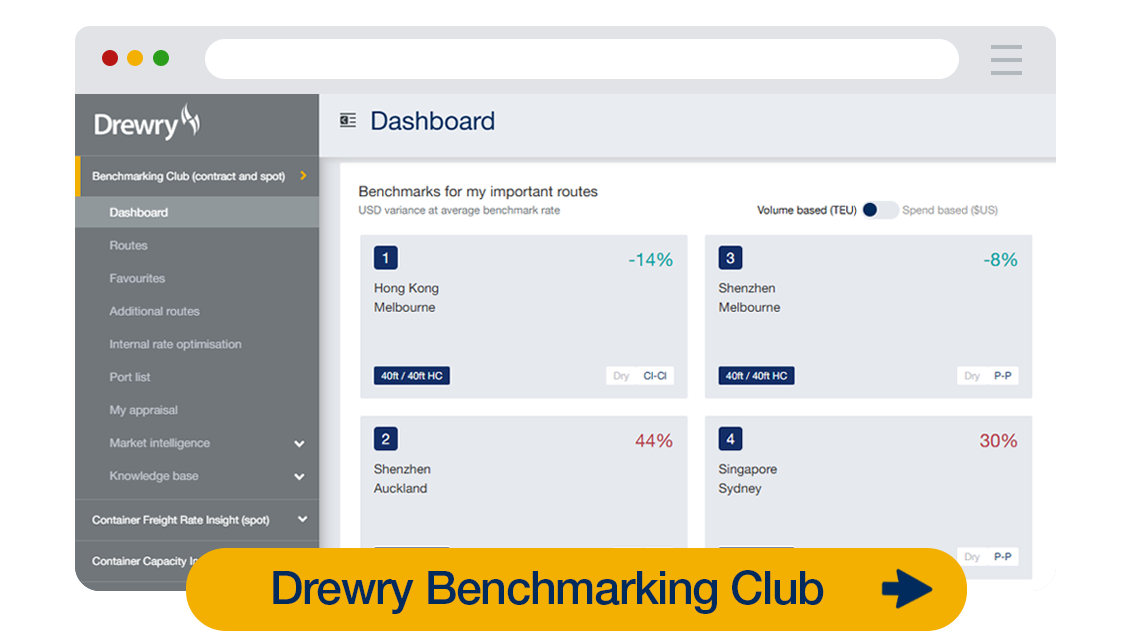

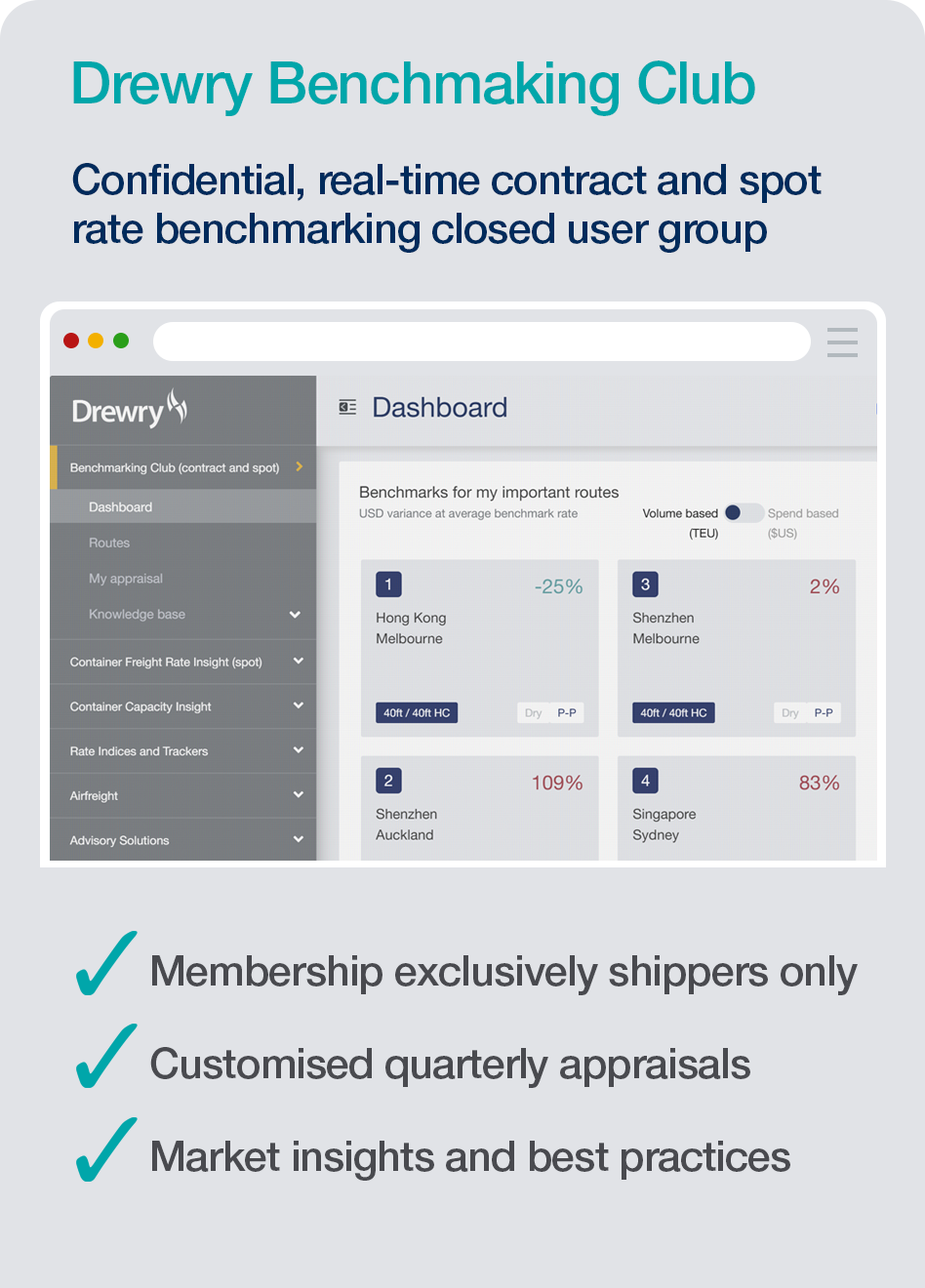

What our clients say about Benchmarking Club

“Drewry is a great resource for market insights, rate indices, and guidance on overall market conditions. Our partnership with Drewry has proven advantageous to our business by helping us establish best practices, refine our contracts and benchmark among the best in the industry.”

Director Global Logistics, Bissell Homecare, Inc.

“Drewry benchmarking [service] has provided us with the insights… to understand how we are positioned, especially important given the volatile and potentially irrational nature of the container marketplace.”

Anonymous, Global home furnishings business

“Drewry’s regular analysis and benchmarking tools help keep us informed on both our own freight rates as well as broader trends in the market. Their insights, reporting and forecasting capabilities truly support our strategic decision making.”

Peter Smith, Global Trade and Commercial Manager, Cotton-On Group

“We selected Drewry’s Benchmarking Club to benchmark our ocean rates with other retail industry leaders and to gain insight into container shipping market trends, forecasts and best practices through webinars provided to Club members by Drewry.”

Logistics Manager, Leading global electronics and home entertainment brand

“Drewry’s Benchmarking Club has made industry rate data and expertise readily accessible. We successfully leveraged their industry knowledge in our annual ocean carrier contract negotiations and continue to do so when evaluating changes to our organization’s sourcing strategies.”

Fortune 100, International US-Headquartered retail brand

“Benchmarking Club data allows us to see trends from both the market and Drewry point of view which provided strategic value on what to expect during the upcoming procurement process. The comparisons of our company’s position in transit times, rates and shipment methods are of particular value.”

Logistics Director, US FMCG Company

“Drewry has been very helpful to us in benchmarking our shipping costs and in developing strategies to improve our shipping efficiency and cost effectiveness.”

Head of Exports, Del Monte (Philippines)

Working with 3 of the top 10 global retailers (National Retail Federation)

Access to an exclusive ocean freight cost benchmarking club comparing costs on over 14 million teu of freight

The first to publish benchmark container spot market freight rates back in 2006.

Related Maritime Research

Track the spot market

Keep up to date with the movements of container spot market freight rates with our popular Container Freight Rate Insight service.Benchmark contract rates

Join our exclusive Benchmarking Club and find out how your contract rates compare to your peers.Monitor your carrier

Understand how your carriers are performing with our online Carrier Performance Insight service.

Container Freight Rate Insight (Annual Subscription)

Online Service · Latest release 31 Dec 2025

Learn more

Drewry Benchmarking Club

Customised Real Time Benchmarking · Latest release 01 Jan 2026

Learn more

View more

© Copyright 2026 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy