China’s halt on US soybean purchases threatens Panamax demand

China’s suspension of US soybean imports amid trade tensions has disrupted seasonal shipping flows, with no cargoes arriving so far this season. Typically, 12 million tonnes move from the US to China between October and November, generating around 120 billion tonne-miles, roughly 12% of the total Panamax demand. The absence of this trade could remove 180–190 Panamax voyages, weakening freight market sentiment.

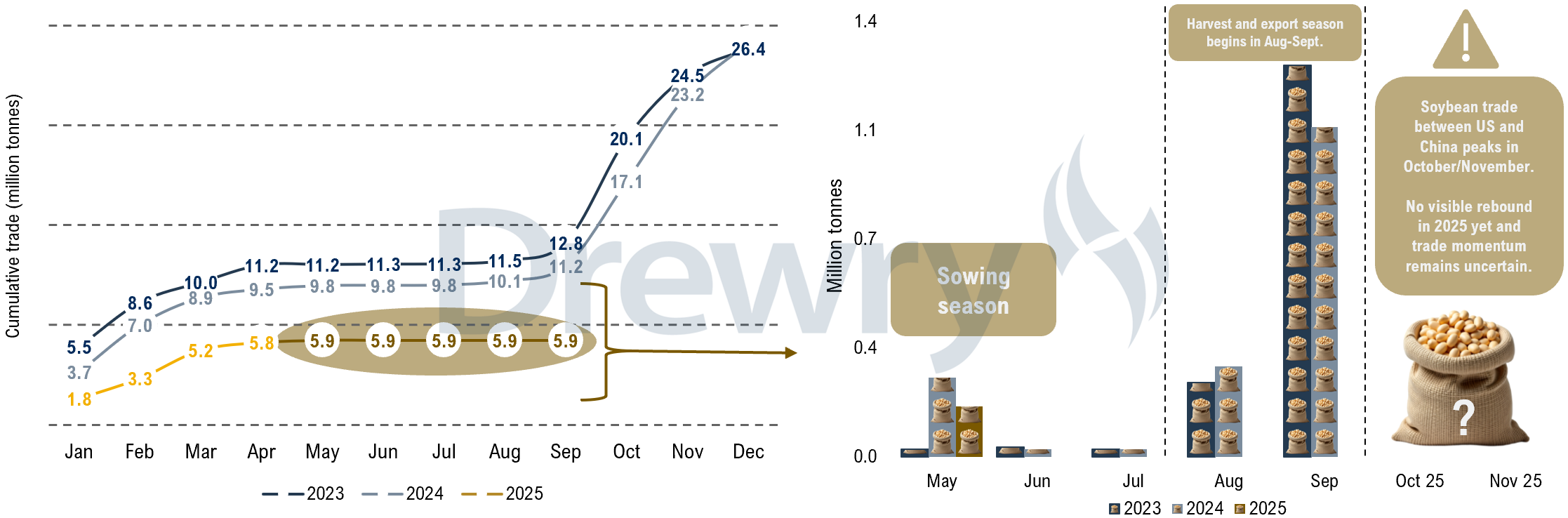

China has decided to suspend purchases of US soybeans as a retaliatory measure against the tariffs imposed by the US on Chinese imports. As a result, no US soybean shipment has arrived at Chinese ports so far this season, when typically around 13 million tonnes of soybean lands at Chinese ports from the US between September and November. Given the seasonal nature of this trade, shipments usually begin to increase in September and reach their peak in October and November. This year, however, more than one million tonnes of soybean trade has already been lost in September, and close to 12 million tonnes remains at risk over the next two months.

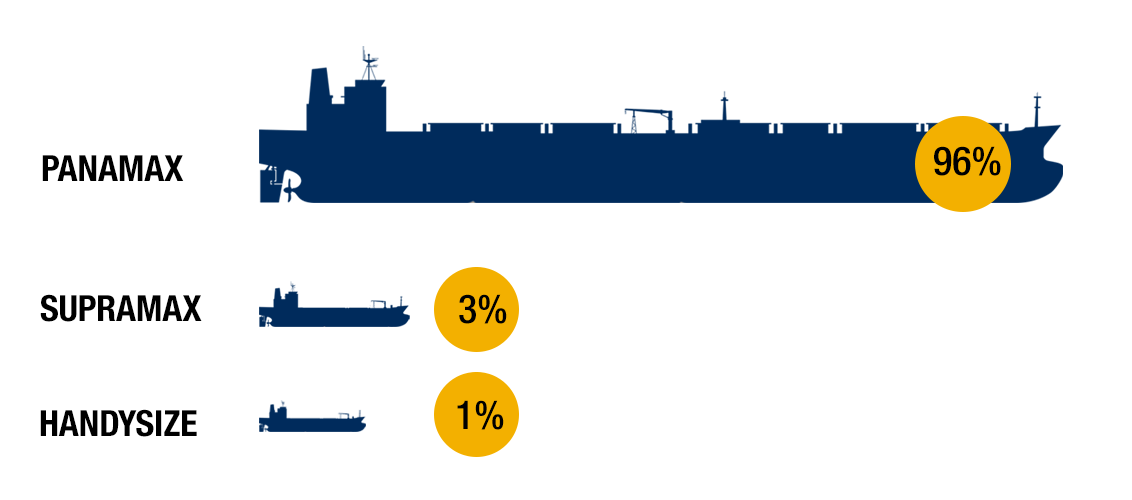

More than 95% of these cargoes are carried on Panamax vessels, translating to roughly 180–190 Panamax shipments in October–November under normal circumstances and generating about 120 billion tonne-miles during the same period. This translates to nearly 12% of the total Panamax tonne-mile demand, which averages around 1,037 billion tonne miles during these two months. Should October and November follow the same pattern as September, with no shipments, Panamax freight rates could come under noticeable pressure.

China typically buys between 25 million tonnes to 30 million tonnes of US soybean annually. While the US might attempt to divert its exports to other destinations, it will be difficult to replace the scale and consistency of Chinese demand. Likewise, China will struggle to find alternative suppliers capable of meeting its needs entirely. Eventually, both sides are likely to resume trade, but if the deadlock extends even for a couple of months, Panamax employment will take a hit during the peak shipping window.

The impact is already visible in the forward freight market. Sentiment has weakened across the mid-size segments, with the Panamax P5TC Baltic FFA for October 2025 (as on 6 October 2025) showing a 9% decline from September’s average rate. The forward curve points to further softness, with November and December contracts down by 12% and 15%, respectively.

Figure 3: Panamax freight sentiment weakens in 4Q25

Note: As on 6 October 2025.

Source: Baltic Exchange, Drewry Maritime Research

Conclusion

The suspension of US soybean shipments to China threatens a key seasonal trade that typically employs 180–190 Panamax vessels between October and November, generating about 120 billion tonne-miles. Reflecting this uncertainty, forward freight agreements for October–December 2025 are being fixed below September averages, highlighting concerns over reduced vessel demand on this route.

Return to...

Related Content

Key Contacts

© Copyright 2025 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy