First EU ETS shipping payment due 30 Sept

Around 13,000 vessels reported their 2024 data on the EU MRV platform in compliance with the MRV guidelines. The CO2 emitted by these vessels in 2024 must be paid for by surrendering 40% EU Allowances (EUAs) for each tonne of CO2. The first due date for the shipping industry to pay its dues is 30 September 2025.

In this article, Drewry analyses the 2024 EU MRV data and attempts to answer some of the key questions arising:

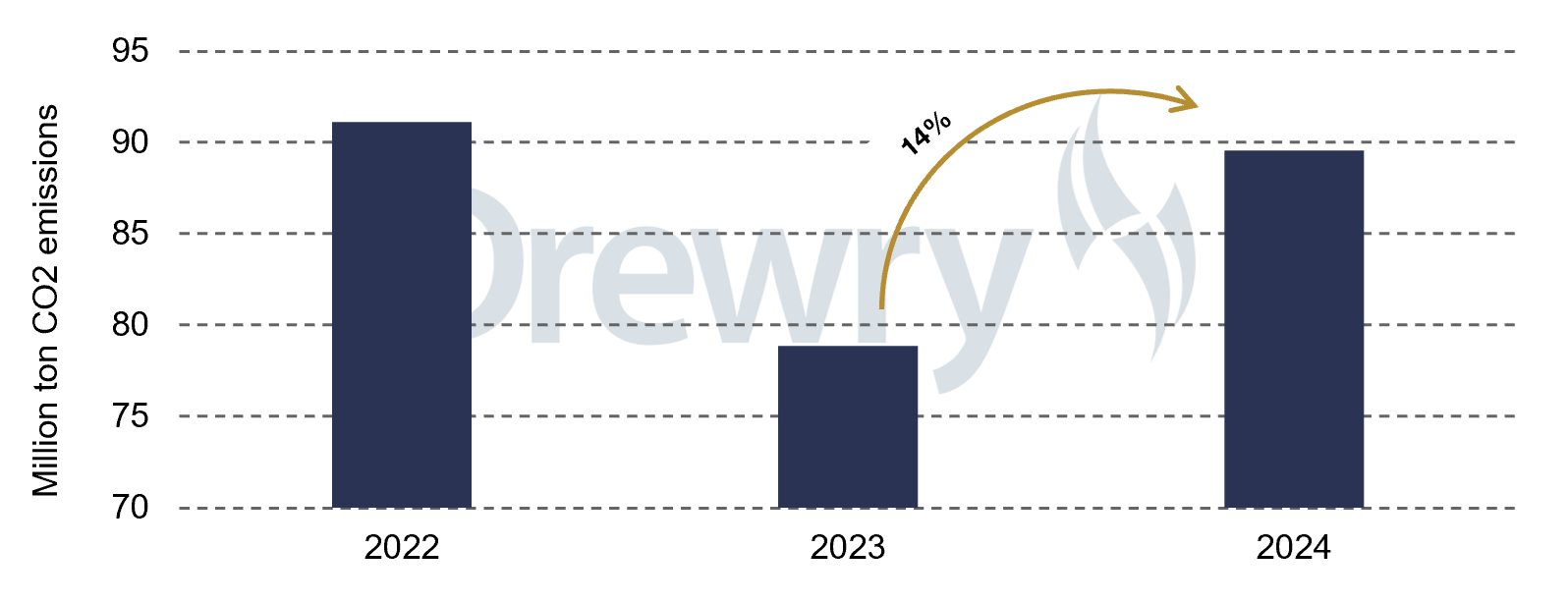

How much CO2 was emitted under the scope in 2024?

Around 90 million tonnes of CO2 was emitted within the scope of the EU ETS, an increase of around 14% compared to the previous year.

This increase is partly due to geopolitical factors, which caused vessels to take the longer route via the Cape of Good Hope instead of the shorter route via the Suez Canal.

Figure 1: Total CO2 emissions under EU ETS scope

Source: EU MRV, Drewry

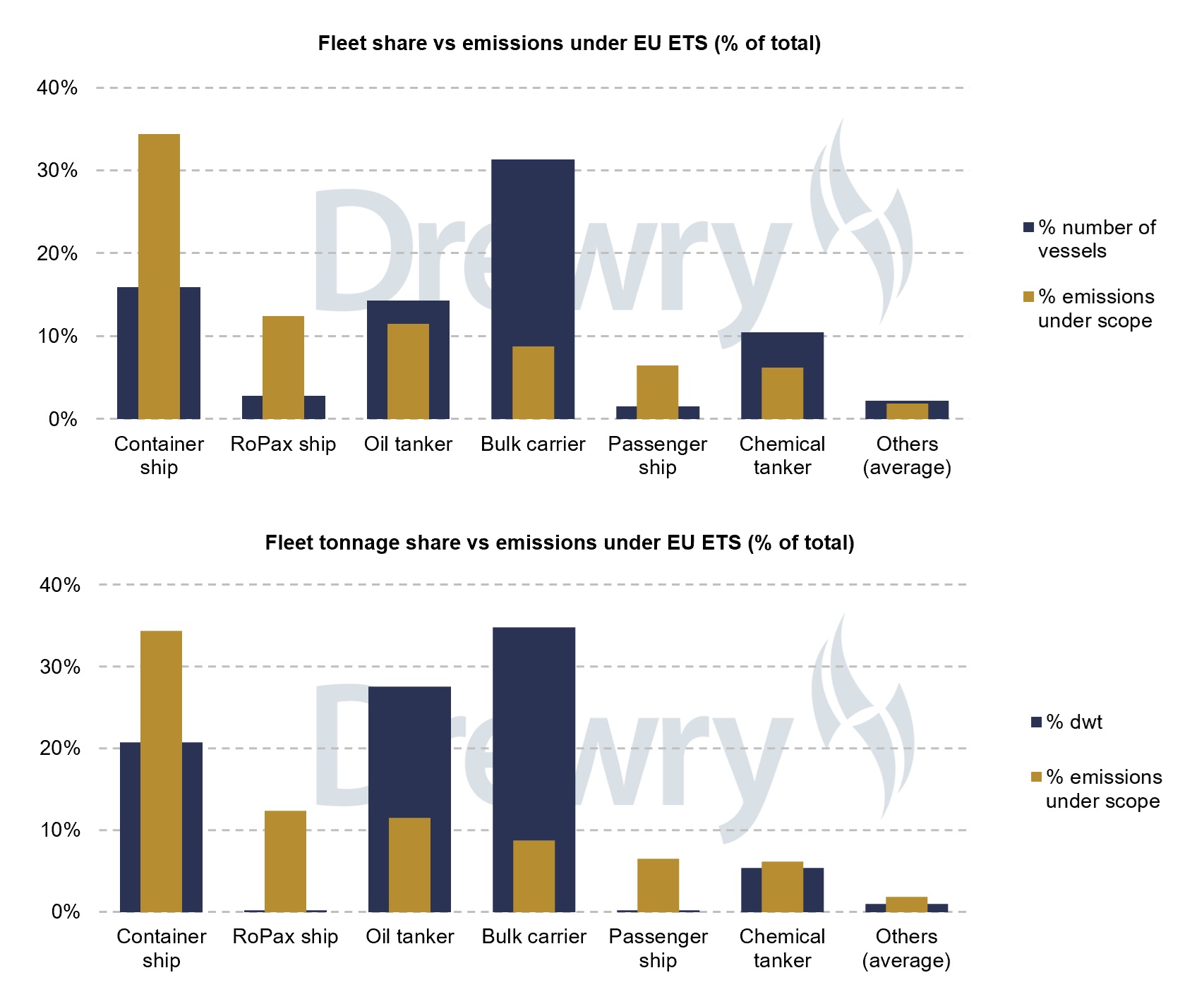

Which sector emitted the most CO2 in the region?

Despite accounting for 16% of the vessels (21% in terms of dwt capacity), the container sector emitted an aggregate of around 34% of the CO2 emissions, according to the EU MRV data.

Figure 2: Fleet analysis vs emissions under EU ETS (% of total)

Note: ‘Others’ include all the remaining sectors with a low % share of emissions under EU ETS scope

Source: EU MRV, Drewry

What will be the financial impact on shipping?

Considering the current price of EUA (around EUR 70), an estimated USD 2.9 billion will be due by the responsible parties in October this year.

If emission levels remain similar, Drewry estimates the total cost to rise to around USD 7.5 billion when the phase-in period ends and all Greenhouse gases (GHGs) are included in the scope (in 2026).

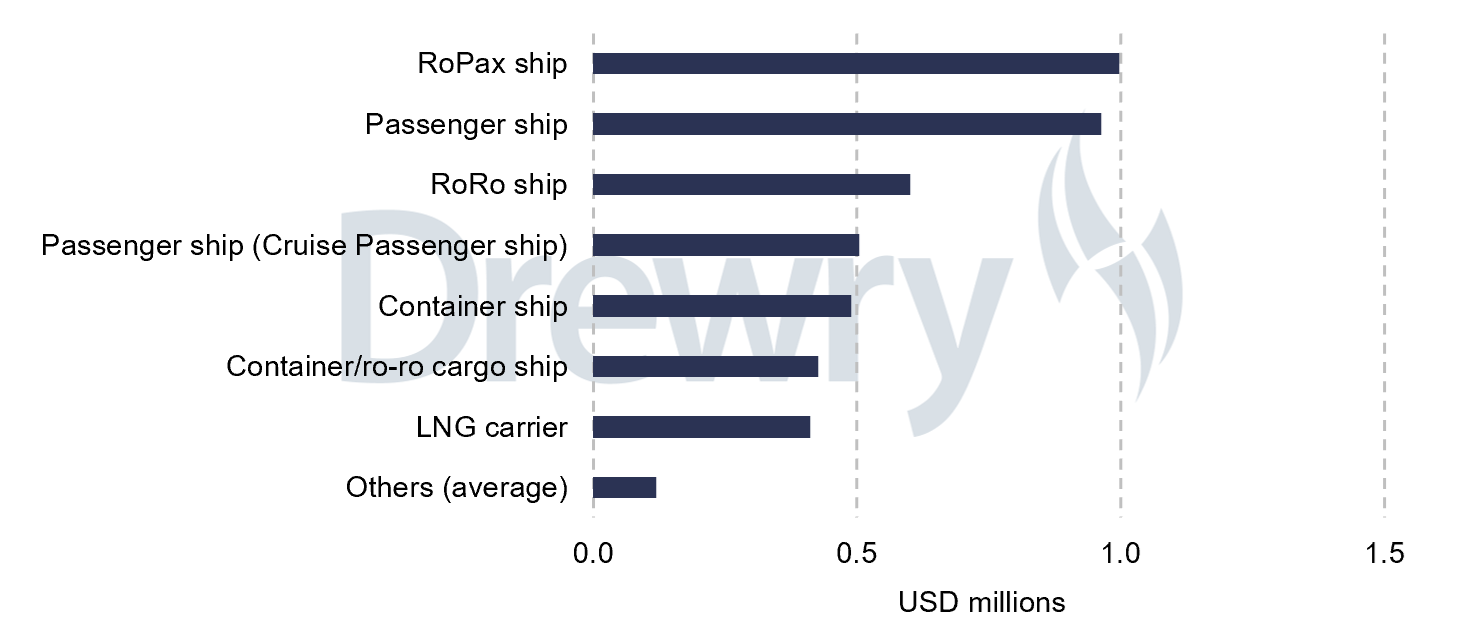

How much would each vessel have to pay on average?

For trading in the EU in 2024, each RoPax and passenger vessel will pay an average of around USD 1 million towards EU ETS, while a container vessel would pay an average of around USD 0.5 million.

Figure 3: EU ETS cost per vessel (average)

Note: ‘Others’ include all the remaining sectors with low EU ETS cost per vessel

Source: EU MRV, Drewry

Mitigating the impact of EU ETS

Shipping companies calling ports in the EU are working towards decarbonising their vessels through various methods:

- Retrofitting energy-saving technologies and propulsion-improvement devices to improve the efficiency of their fleet

- Using sustainable biofuels

- Introducing alternative-fuel vessels in the fleet

- Retrofitting existing vessels to run on alternative fuels

- Using advanced antifouling and low-friction paints

Container companies such as Maersk, CMA CGM and Hapag-Lloyd have responded to the EU Emissions Trading System (EU ETS) by introducing transparent surcharges to cover the cost of emission allowances. Alongside these surcharges, they offer specialised services that allow customers to choose shipping options powered by alternative fuels or green solutions (such as biofuels or green methanol), helping to significantly reduce their Scope 3 emissions. These services are typically marketed under brands like Maersk’s “ECO Delivery”, CMA CGM’s “ACT+” and Hapag-Lloyd’s “Ship Green”.

Marching towards net-zero

Geopolitics muted the positive impact of the EU ETS, compelling vessels to take longer voyages through the Cape of Good Hope. The regulation's gradual phasing in will increase the cost burden on polluters and could encourage them to reduce carbon emissions in the region.

It will be interesting to see how the FuelEU Maritime, which came into force in 2025, improves GHG emissions in the region, along with the expected IMO Net Zero Framework (NZF). The EU plans to review its regulations to align them with the latter after its likely adoption in October this year.

These regulations are intended to reshape the industry by:

- Increasing the demand for alternative-fuel vessels

- Replacing the shipping industry’s energy demand with renewable sources

- Increasing the use of modern technologies to improve efficiency and harness renewable energy onboard

Conclusion

The increasing GHG regulations signal a decisive shift in global shipping practices, marking an end to the era of voluntary emission reductions and instead making polluters accountable. For shipowners and operators, the challenge is not only to meet these requirements but also to leverage them as catalysts for innovation, efficiency, and long-term competitiveness. With the transition to net zero already underway, ship operators that act early will position their vessels for sustained competitiveness and market longevity.

Key Contacts

© Copyright 2025 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy