IMO DCS 2024: A reality check for shipping

The IMO Secretariat has submitted a summarised report on the data collected in 2024 through the IMO Data Collection System (DCS). This data will be reviewed by the MEPC during its next session in April 2026. Drewry’s Energy Transition team closely tracked this verified data to assess the industry’s progress.

Trends in fuel consumption

Annual fuel consumption was around 223 million tonnes in 2024, of which alternative fuels accounted for around 16.7 million tonnes. The progress of alternative fuel consumption has been slow but upwards, increasing from 5.9% of the shipping energy demand in 2019 to 8.7% in 2024.

Source: IMO DCS, Drewry Maritime Research

Biofuel was the major driver for increased consumption of alternative fuels, surpassing the 1 million tonne mark in 2024 and contributing 6.2% to the demand for alternative fuel energy. The IMO Secretariat highlights the need to improve the current reporting provisions for biofuels, as the categorisation of these fuels under “others” creates uncertainty. Among alternative fuels, the share of methanol has gradually increased threefold since 2019 (0.11% in 2019 to 0.34% in 2024).

Source: IMO DCS, Drewry Maritime Research

Is the adoption of alternative fuels reducing emissions?

Overall, CO2 emissions from vessels reporting on IMO DCS rose 5.5% YoY in 2024. Even as ships reduce their operational speeds to lower their carbon-emission intensity, demand for vessels has been increasing to serve global trade and to cater for the longer Cape of Good Hope (COGH) route due to the Red Sea crisis, raising absolute emissions from the shipping sector. In response to this higher demand, the container sector recorded an 11.7% increase in deadweight tonnage in 2024, the highest among all sectors.

While the global fleet’s average speed has dropped since regulations such as the Energy Efficiency Existing Ship Index (EEXI) and the Carbon Intensity Index (CII) came into effect, the average speed of the container and LNG sectors increased in 2024. The latter’s average speed increased slightly as a few of its slower steam turbine vessels were scrapped.

The ratio of CO2 emissions per unit of distance travelled has been declining, thanks to the reduction in speed, and installation of propulsion improvement devices and energy-saving technologies. However, the increase in average vessel size is leading to higher CO2 emissions per vessel in the fleet.

Regulation push continues, but average compliance reduces

With 2024 being the second year of the CII regulation, vessels were expected to implement energy efficiency measures to comply, but instead, the fleet's average compliance1 decreased 0.5% in 2024 (from 77.8% compliant vessels in 2023 to 77.3% in 2024).

Upon comparing the 2024 CII data with the previous year’s ratings shows that major cargo-carrying sectors, other than Gas carriers (including LNG carriers), are struggling to maintain compliance. For instance, the share of compliant vessels in the container sector decreased 5% in 2024 due to increases in speed, deadweight tonnage and hours underway.

Increase in % share of CII-compliant vessels, 2024 vs 2023

Note: The above calculation includes only vessels that reported their CII ratings to IMO DCS.

Source: IMO DCS, Drewry Maritime Research

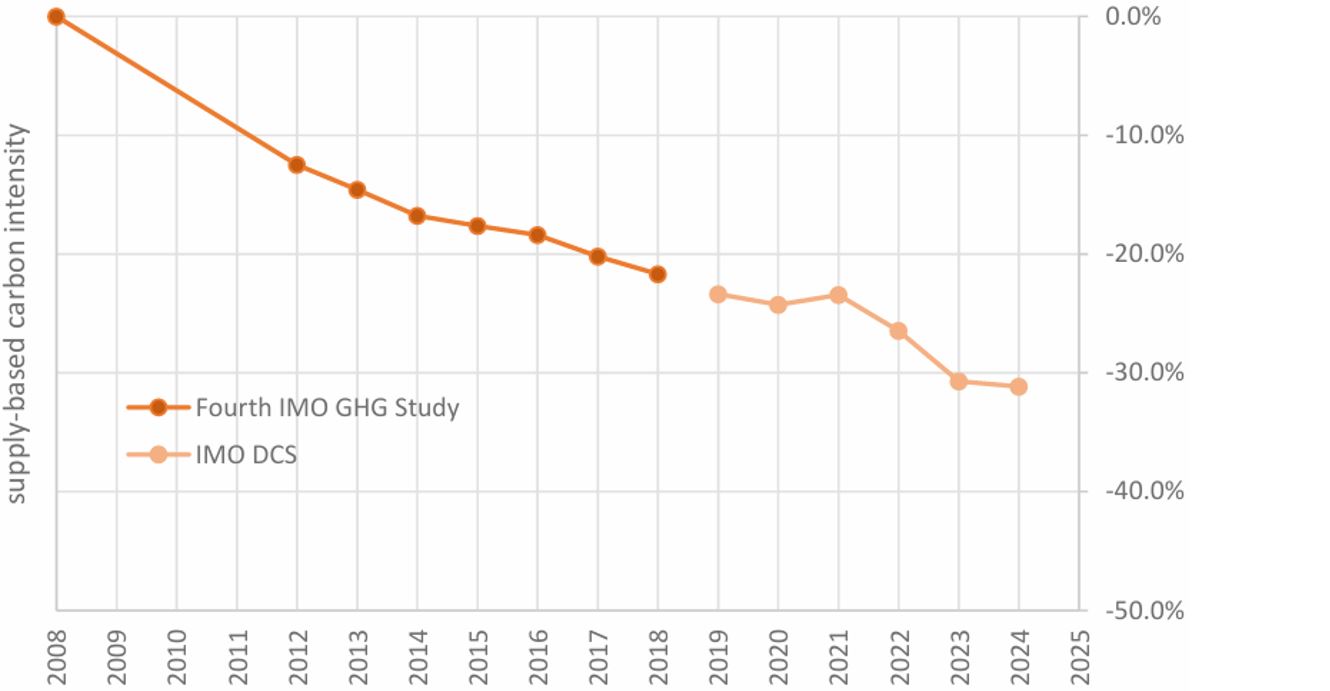

That said, the report also highlights a 0.5% further reduction in supply-based carbon intensity2 , taking it 31.5% below 2008 levels. This can be attributed to the increase in deadweight tonnage and distance covered by shipping, along with limited increase in fuel consumption in 2024 compared to 2023. The IMO has until 2030 to reduce carbon intensity by 40% to meet its target.

Supply-based (AER) carbon intensity of international shipping, 2008–24

Source: IMO DCS

1 For this analysis, A-, B- and C-rated vessels are considered CII-compliant, whereas vessels with D and E ratings are considered non-compliant. While these non-compliant vessels are still allowed to sail for now, they are required to comply in the upcoming years.

2 “Supply-based carbon intensity” considers the carbon emissions with respect to aggregate capacity of available vessels.

Conclusion

As the world inches closer to the 2030 IMO GHG targets, Drewry has taken a reality check by analysing the IMO DCS 2024 data. While it is encouraging to see the progress made towards the target ‘40% reduction in carbon intensity’, with around 8.5% of the target remaining till 2030, the ‘20% reduction in GHG emissions’ target seems farther now, as the industry released 5.5% more CO2 than in 2023. Moreover, the target for adopting zero- or near-zero fuels/technologies/energy sources is far from being met.

The stakeholders will closely monitor developments before the IMO meet again in October 2026, hoping for an outcome that propels shipping towards net-zero. The adoption of the Net-Zero Framework (NZF) will encourage the industry to increase the adoption of zero- or near-zero fuels/technologies/energy sources. Till then, major shipping companies continue to inch closer to their individual net-zero targets by switching to low/zero carbon alternative fuels, retrofitting vessels with various emission reduction technologies, energy saving devices, optimising voyages and taking other measures.

Key Contacts

© Copyright 2026 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy