Red Sea ceasefire: A wait-and-watch moment for breakbulk shipping

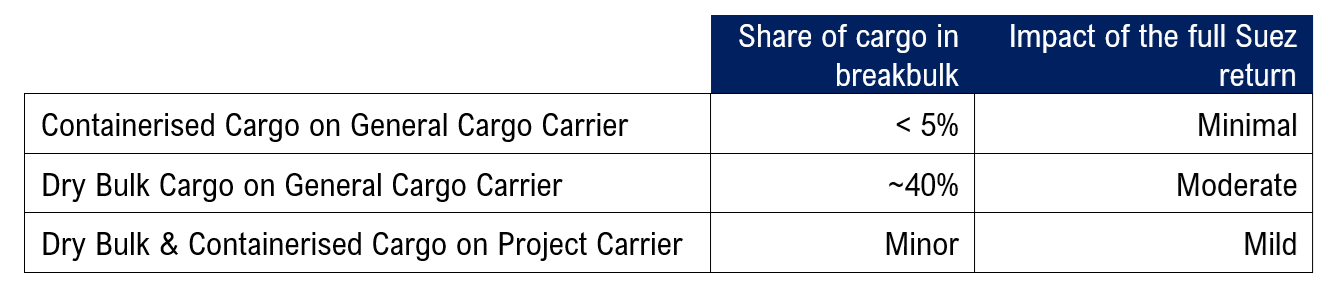

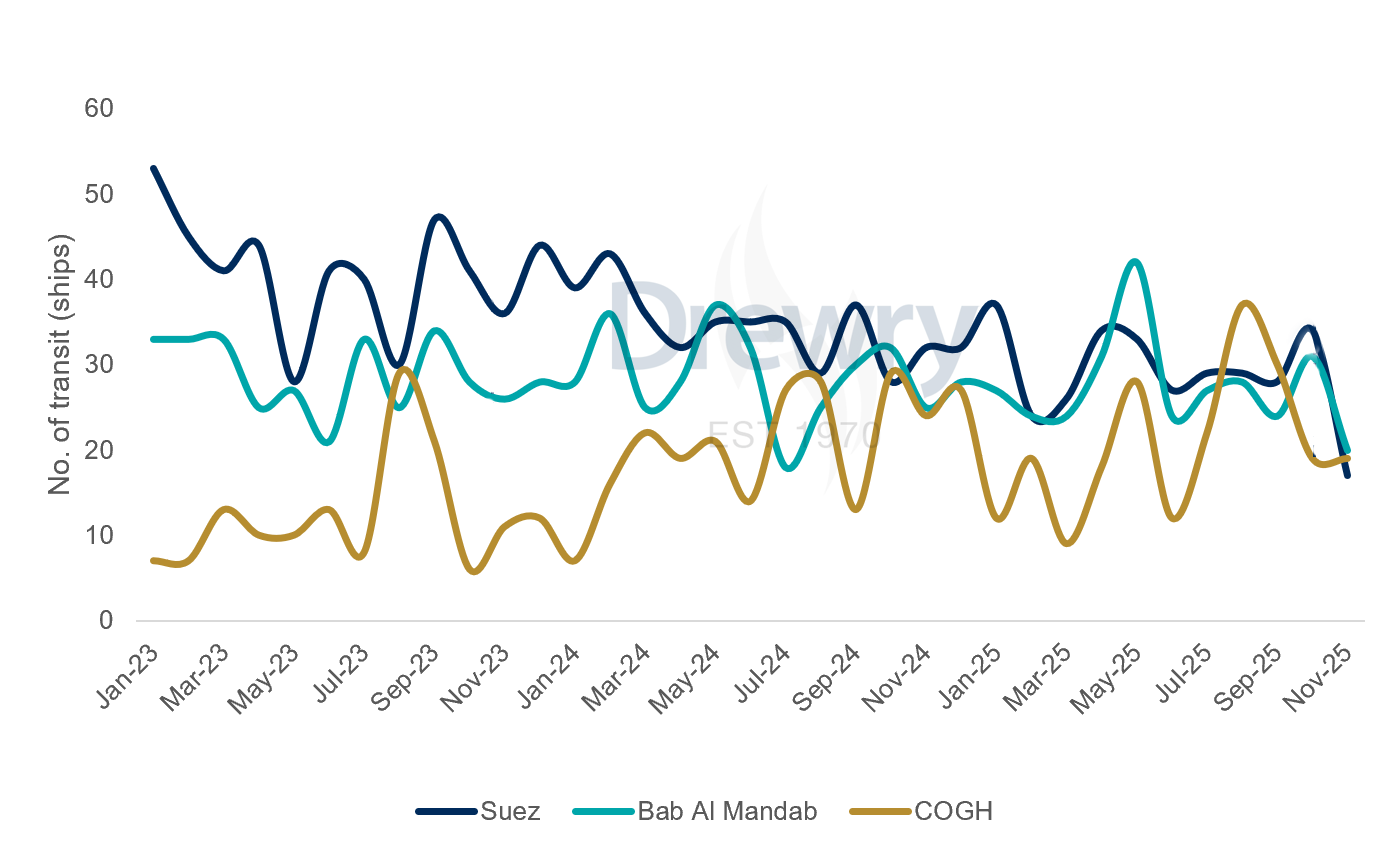

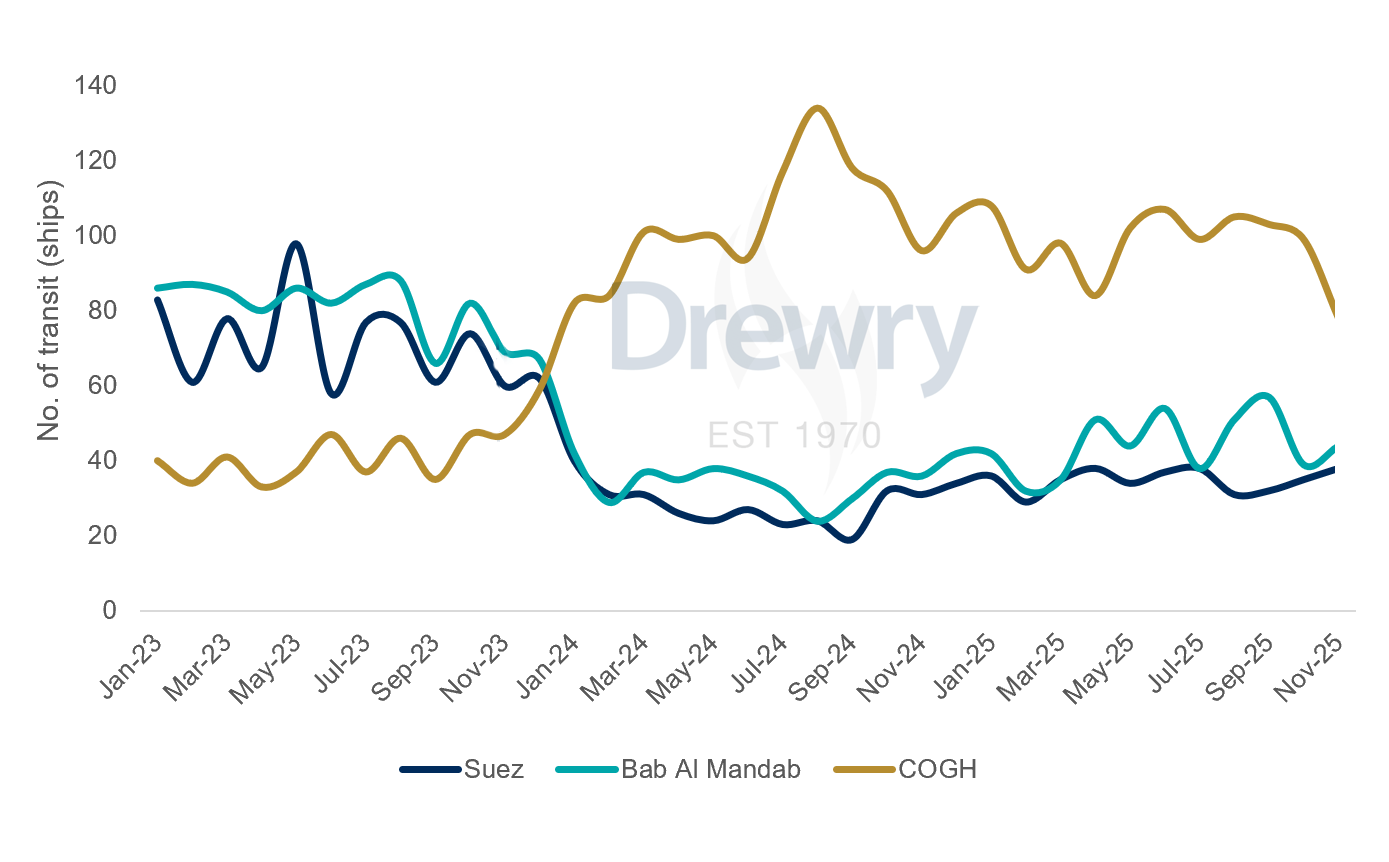

With the Red Sea ceasefire in place and a rising number of container vessels returning through the Suez, breakbulk shipping is expected to face increased competition. It may exert slight downward pressure on General Cargo day rates, while tonne-mile demand for Project Carriers could contract on this route, affecting rates. Shorter routes via the Suez will free up capacity and reduce tonne-miles, although demolitions of older ships and limited newbuilds should stabilise vessel supply. Despite optimism about ceasefire progress, operators remain cautious since traffic in the Suez is still below pre-crisis levels. Drewry expects breakbulk shipping to recover gradually, with fully restored and efficient routings via the Suez by the end of 1H26.

Breakbulk ships will face rising competition from containers

If the ceasefire holds and container vessels resume transits via the Red Sea in large numbers, the traffic is likely to surge, but this would not lead to immediate stability. A sudden influx of ships could lead to port congestion, delaying a full return to normal trade patterns. However, the outcome depends on how this benefits shippers, who may have to bear higher insurance costs and canal tolls through Suez or face elevated bunker prices via the COGH, along with stretched voyages.

A resumption in container traffic will affect the breakbulk sector and will lead to:

- Rising competition: Container lines will take up some of the general cargo commodities into boxes, squeezing breakbulk volumes as shippers may opt for cheaper containerised options.

- Cargo contestability: Competition will intensify for cargo types that are container-substitutable, including those carried in General Cargo ships, such as:

- Steel coils and plate

- Bagged/packaged commodities (cement, fertilisers, wood pulp, etc.

- Palletised machinery, pipe bundles and smaller modules

Fierce competition from container lines will have a limited impact on the General Cargo segment, as these vessels often carry cargo which is better suited for dry cargo vessels than containers. However, a full return of vessels via the Suez Canal could increase the competitiveness as transit times shorten and network efficiency improves across all segments.

When it comes to project cargo, container lines are competing for this business, particularly when they have excess slot capacity available. A common arrangement involves loading a single large project around mid-ship, secured on a series of flatrack containers.

A similar pattern is emerging in the dry bulk sector. For instance, Vestas has indicated that it regularly uses Handy and Supramax bulk carriers to move lighter project cargo on their open top decks. At the same time, the reduction in tonne-miles on this route could offer some relief to shippers in terms of time charter rates.

General Cargo vessels were less impacted by the Red Sea crisis that began in November 2023 because they rely less on that route. However, a complete reopening of the Suez Canal will shorten voyages and lower transportation costs. As operations normalise, these carriers might need to revise their services, port calls and schedules to regain the efficiency seen before the crisis.

Project Carriers were the most impacted by the Red Sea crisis due to their high-value, time-sensitive cargoes and the need for extensive rerouting. If the route fully reopens, particularly with strong breakbulk demand in sectors like infrastructure and energy, the capacity freed by shorter Suez transits is likely to be absorbed by the growing demand for these goods. Initially, this could put downward pressure on charter rates due to lower vessel utilisation; however, sustained demand for heavy-lift cargo is expected to keep rates at profitable levels for vessel operators.

Key implications

A full return to using the Suez Canal will release significant capacity into the breakbulk market, reducing tonne-miles, vessel utilisation and earnings for carriers that benefited from the longer COGH route. Moreover, the market will also face port congestion, stiff competition from low-cost container services and slight downward pressure on spot rates. A stable Red Sea ceasefire could further intensify competition and shift some cargo to containers. Meanwhile, Project Carriers may be affected, but steady demand, driven by energy infrastructure projects, is likely to restore rates to pre-crisis levels.

Return to...

Related Content

Key Contacts

© Copyright 2026 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy