Under strain but holding course: MGCs in a shifting LPG landscape

MGCs have long played a pivotal role in seaborne LPG and ammonia trades even though they comprise just 9% of the global LPG fleet. Apart from serving key LPG routes originating from the US and the Middle East (prominently meeting India’s LPG demand), they also dominate the ammonia trade.

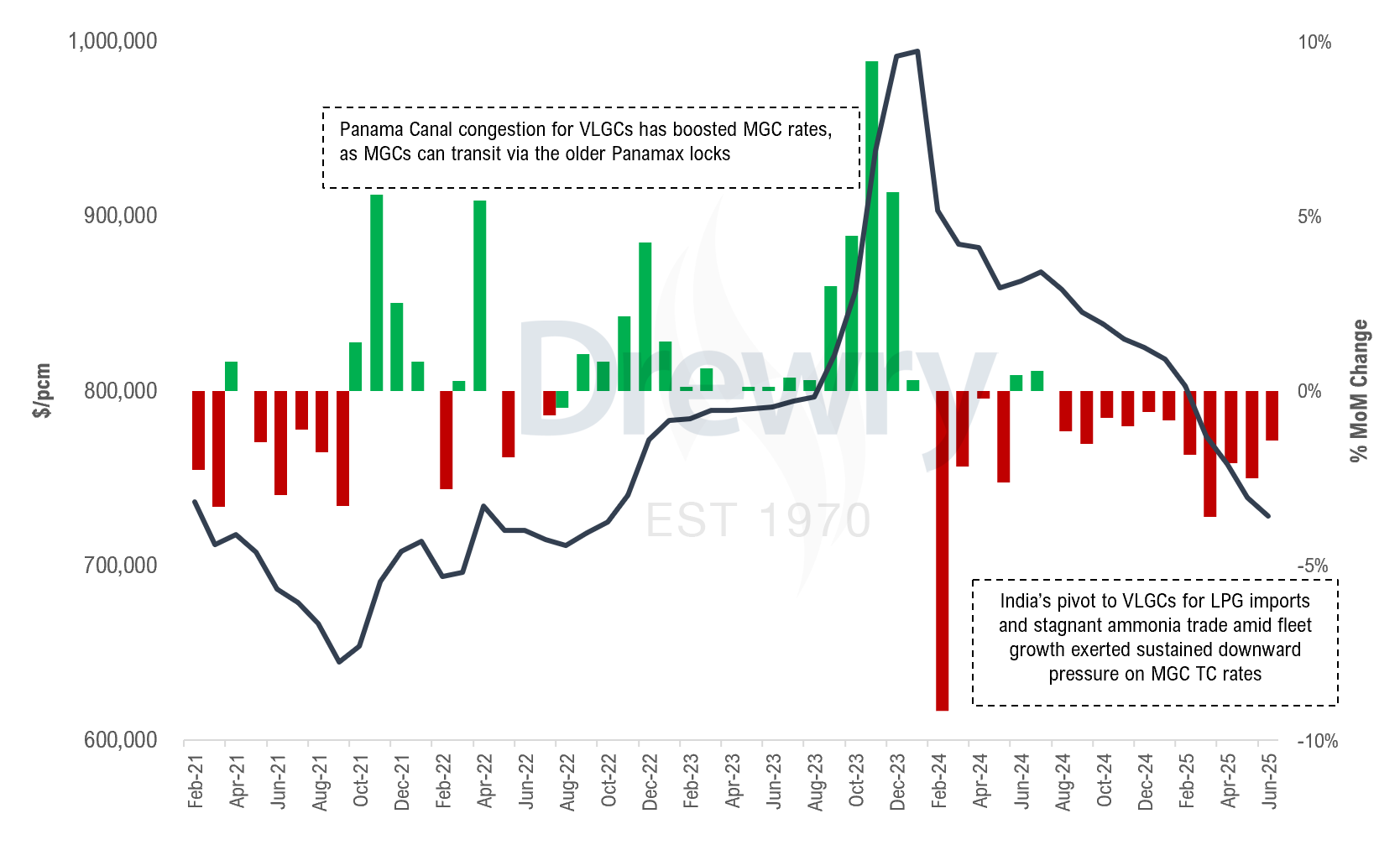

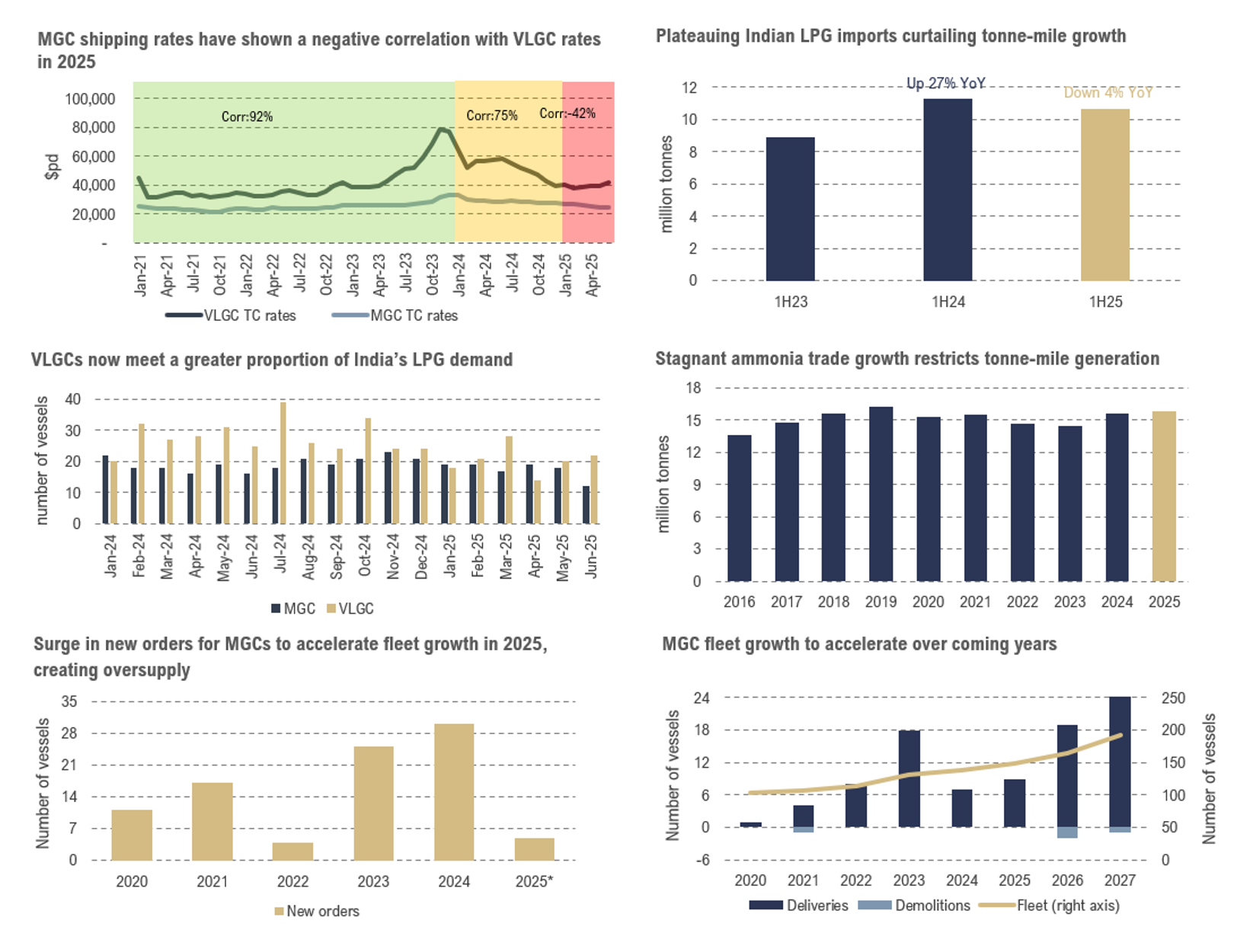

However, since early 2025, MGC shipping rates, which typically follow the VLGC market, have diverged, showing a negative correlation and therefore marking an interesting phenomenon in LPG shipping not seen since the 2015 market collapse.

Despite their reputation as the ‘workhorses’ of LPG shipping, MGCs are facing structural headwinds from shifting trade patterns and expanding VLGC-compatible infrastructure in key Asian hubs.

1) VLGC oversupply and its ripple effect: Rapid fleet expansion in the VLGC segment (with 25 vessels delivered since January 2024) has created an oversupply situation which is exerting downward pressure on the segment’s TC rates. The knock-on effect of this influx is being felt in the MGC segment, where older VLGCs—offered for employment at discounted rates—are increasingly preferred by charterers, displacing MGCs on traditional short-haul and mid-haul routes.

Additionally, the rise of shadow fleets, particularly for the Iran–China LPG trade, has intensified competition for MGCs. These shadow fleets, which often comprise ageing VLGCs, are deployed for STS operations and short-haul voyages, further eroding MGC’s market share.

2) Shifting trade fundamentals and their impact on tonne-mile demand: While the spillover from VLGC oversupply has pressured MGC rates, structural shifts in MGC demand fundamentals has compounded the decline. These include:

India’s changing LPG landscape: India’s LPG demand, once a key driver of tonne-mile demand for MGCs, is showing signs of plateauing and thereby reducing vessel demand. The country’s LPG imports declined 4% YoY in 1H25.

- Meanwhile, upgraded port infrastructure favouring VLGCs—like the recently upgraded Pipavav terminal and cargo swaps triggered by the ongoing US–China tariff war—has created a long-haul US–India trade route.

- Overall, the country’s attempt to diversify its LPG supplies away from the Middle East increasingly supports VLGC deployment over MGCs.

Stagnation in ammonia trade: The global seaborne ammonia trade is currently dominated by MGCs. However, as the trade has been stagnant, it has impacted vessel demand. While optimism around the potential for green ammonia trade is resulting in charter demand for MGCs and higher MGC orders, the slow ramp-up of new projects constrains growth.

- Of the 370+ proposed green ammonia projects, only a handful (aggregating 8 mtpa) are seen as realistic, with operations likely to start by 2028.Competition with older VLGCs and limited demand for ammonia trade are impacting the segment’s employment and earnings potential.

3) Rising newbuild prices: MGC newbuild prices have risen 24% since 2023 to average $80 million in 2Q25. Rising newbuild prices, declining TC rates along with slowing green ammonia build-up have deterred new orders in the segment, raising concerns over further expansion of the fleet.

Earnings over the long term will not see a significant decline

Despite current challenges, the long-term outlook for MGCs is not entirely bleak. Several factors are working in favour of the segment, encouraging MGC rates to remain stable with respect to VLGCs, where vessel surplus will likely erode earnings.

- Rising Southeast Asian LPG imports: Rapid urbanisation, rising population and supportive energy policies indicate an increasing appetite for LPG in countries like Indonesia, Vietnam and the Philippines. Moreover, expansion of the petchem sector in Vietnam and Thailand and the growing prominence of regional hubs like Singapore, Batangas and Map Ta Phut are driving MGC demand.

- Growing US–Europe LPG flows: As European markets increasingly opt for direct US imports over ARA re-exports amid efforts to reduce reliance on Russian supply, MGC employment opportunities on Transatlantic routes are bound to rise.

- First segment for green ammonia trade: While growth is slow, the ammonia trade will remain a core pillar for MGCs. Limited new merchant capacity (2.5–3.0 mtpa by 2028) will favour MGC deployment on intra-regional and US–Europe routes through 2032, even as VLAC deliveries begin.

- Limited fleet size and higher utility: The MGC fleet consists of 140 vessels, far lower than the VLGC fleet, meaning that the segment can adapt better in the event of a vessel surplus. Moreover, MGCs can be specialised for ammonia or ethane/ethylene trade as their size (30-50 kcbm) offers a flexible solution for ports with draft restrictions or limited infrastructure.

Furthermore, as 13 of 18 ammonia DF vessels are MGCs, the segment is well-positioned to thrive under tightening IMO regulations.

The MGC segment is at a crucial juncture in 2025, shaped by shifting trade patterns and mounting competition from larger carriers. However, its size dynamics, utility, fleet modernisation, role in green ammonia trade along with rising LPG demand in Southeast Asia and US–Europe are key catalysts, supporting sustained growth of the segment.

Related Content

Key Contacts

© Copyright 2025 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy