Rising yard days could tighten supply ahead

Repair yard days for Capesize ships are climbing again in 2025, this time driven by a wave of retrofits due to EU ETS and FuelEU Maritime regulations. With vessels heading into yards for upgrades ranging from various decarbonisation retrofits such as Propulsion Improving Devices (PIDs) and Energy Saving Devices (ESDs), effective supply is being sucked out of the market, lifting utilisation of the tonnage that remains on the water.

Repair yard days for Capesize ships have risen in 2025 as owners brace for a new wave of regulatory pressure. The combination of CII compliance adjustments, preparations for the EU ETS moving to full force in 2026, and the tightening of FuelEU Maritime requirements is pushing vessels into yards for modifications. This time, the work goes beyond simple fixes. Along with PIDs/ESDs, owners are looking at shaft generators, hybrid systems, etc. The aim is not just to meet the rules but to lower carbon exposure and avoid penalties that will grow heavier from 2026 onward.

Repair yard days are increasing not because of a single regulation, but as part of a longer transition into a carbon-constrained shipping market. These retrofits will continue to absorb capacity, temporarily tightening supply and lifting utilisation of the ships that remain on the water.

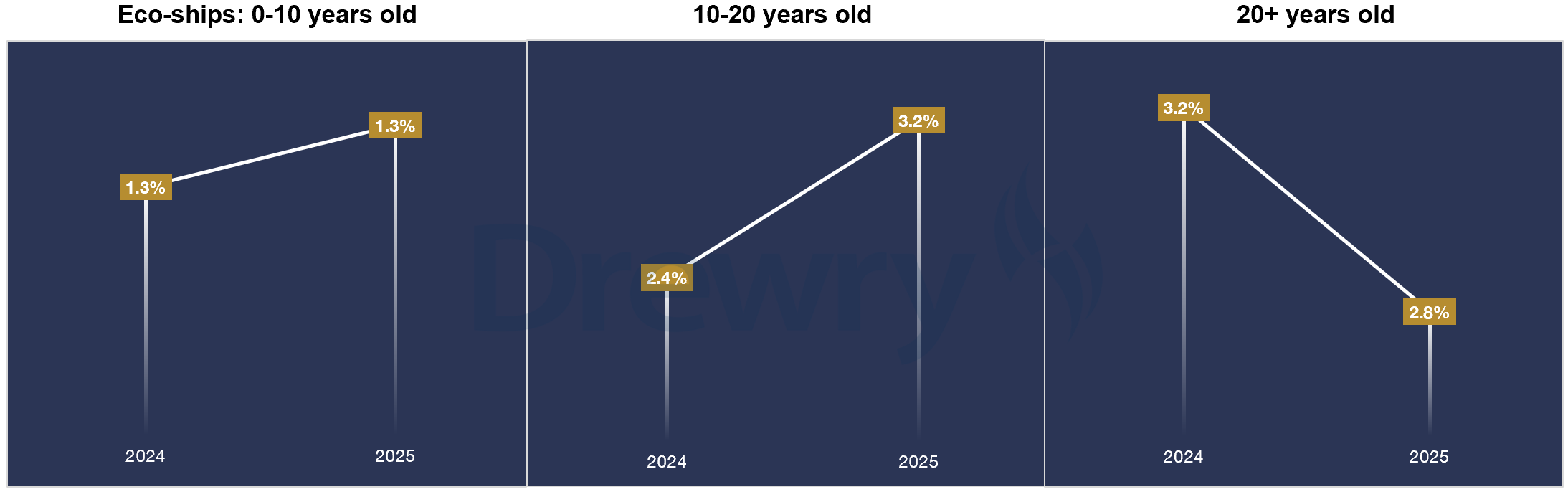

The age profile of the fleet has added another layer to this story as more than half the Capesize fleet is between 10 and 20 years old. This age profile is seeing the biggest jump in yard stays as these ships typically need the most retrofitting and fine-tuning to remain competitive under tightening carbon rules. By contrast, the under-10-year-old eco-ships usually require lighter adjustments, and so their repair days have remained low whereas ships that are more than 20 years old are spending less time in the yards in 2025. Many of the aged vessels are running on borrowed time and are likely to head for the scrapyards sooner rather than later, and so owners are reluctant to invest in costly upgrades.

We have seen similar episodes before. In 2019–20, the industry was preparing for the sulphur cap. Many owners installed scrubbers to keep burning high-sulphur fuel oil, leading to extended yard stays that were often paired with scheduled drydockings.

In 2022, repair days rose again, this time driven by the first round of EEXI and CII compliance work. That phase was largely about meeting certification requirements. The vessels were at yards for engine power limitation and technical adjustments rather than deeper retrofits. For most ships, EEXI certification was due at their 2023 IAPP surveys, which concentrated the modifications in 2022. CII, meanwhile, required annual emissions reporting starting from 2023, with the first ratings published in 2024. Many owners used their 2022 yard time to prepare monitoring systems and make small tweaks to improve performance before the reporting began.

Each of these spikes tells the same broader story: regulation could squeeze effective supply. What was once occasional, linked to one-off rules such as ballast water or sulphur, is now turning into a cycle of continuous adjustment. For Capesizes, 2025 is another chapter, and with EU ETS and FuelEU Maritime ramping up, it won’t be the last

Conclusion

Each regulatory wave, sulphur in 2020, efficiency in 2022, and carbon in 2025, has pulled ships into yards and squeezed effective supply. What we’re seeing now is not a one-off but a cycle that will keep repeating as decarbonisation rules tighten. For Capesizes, this means more periods of lost trading days ahead, with regulation itself becoming a structural factor in market balance and utilisation.

Return to...

Related Content

Key Contacts

© Copyright 2025 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy