Browse Services by Sector

Container ShippingContainer Equipment Assets

Ports and Terminals

Dry Bulk Shipping

Tanker Shipping

Gas Shipping

Specialised Shipping

Airfreight Transport

Logistics Management

Ship Operations and Management

Other popular areas

Browse subscriptions by Sector

Container ShippingPorts and Terminals

Dry Bulk Shipping

LPG Shipping

LNG Shipping

Crude Tanker Shipping

Product Tanker Shipping

Financial Advisory

Valuations

Drewry Financial Research Services Ltd is authorised by the UK Financial Conduct Authority (FCA).

US tariffs - First reaction and analysis

03 Apr: Philip Damas, Head of Drewry Supply Chain Advisors provides a first reaction to the wave of tariffs announced by US President, Donald Trump on Wednesday.

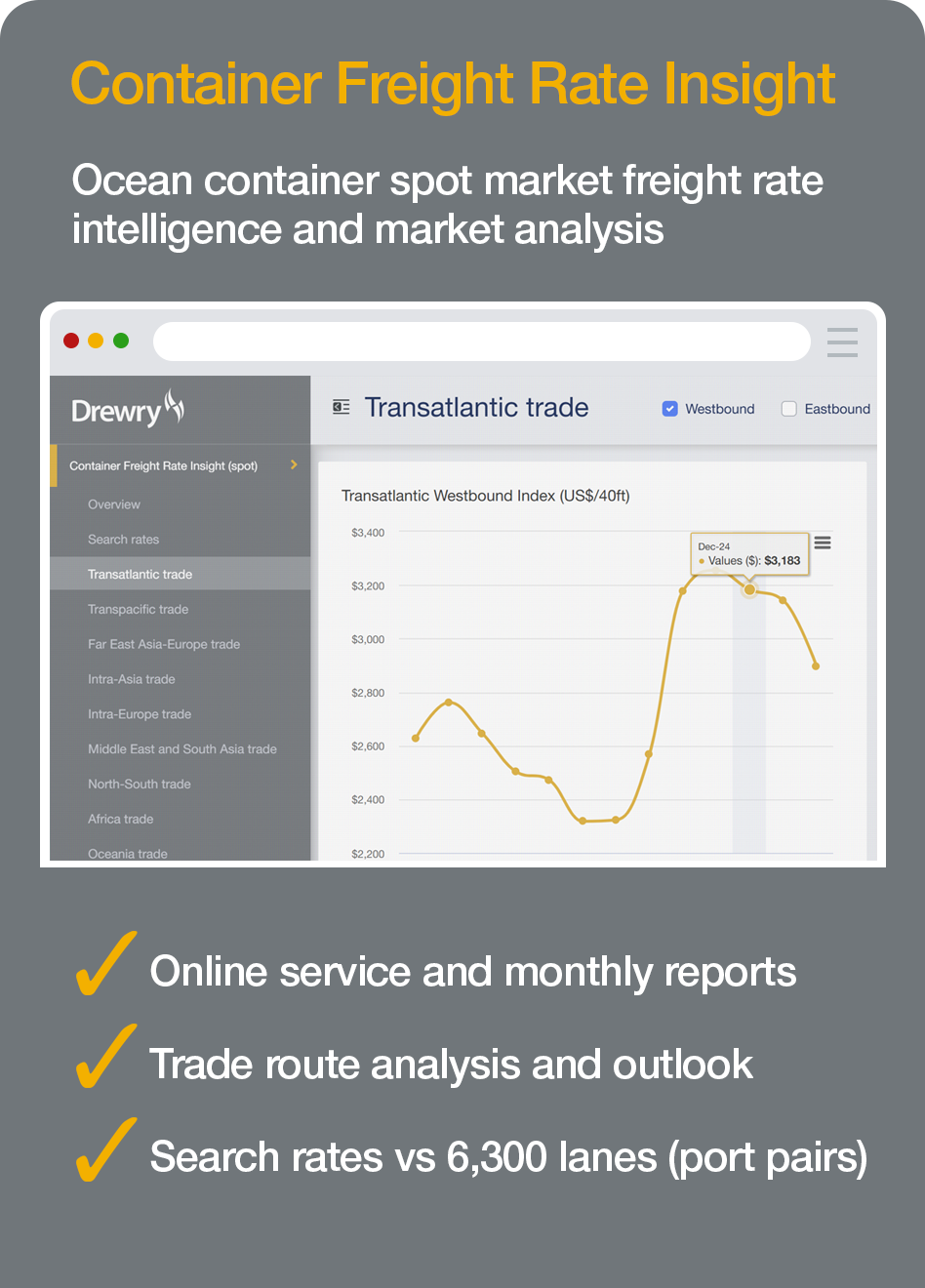

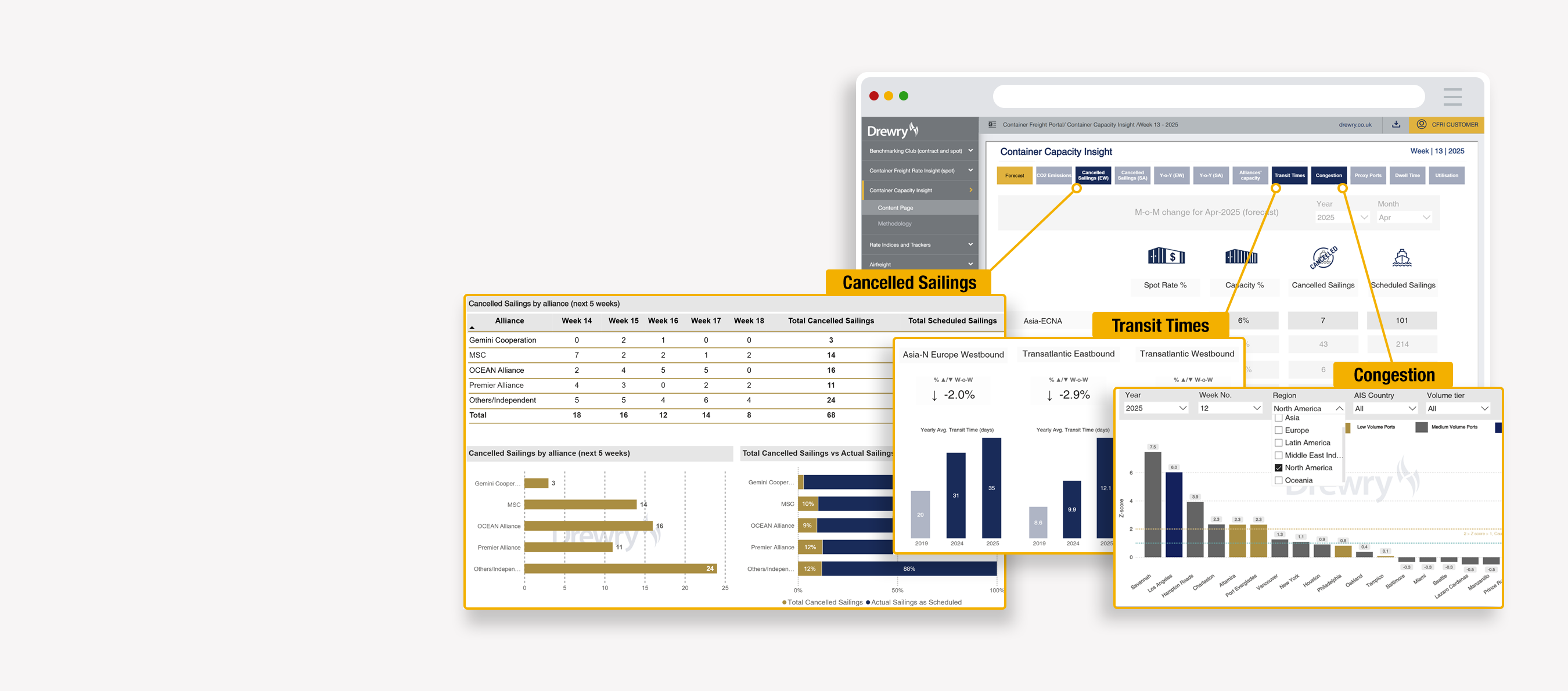

Container Capacity Insight

Essential weekly ’pulse-check’ covering key areas such as global service schedules, capacity, freight rates, congestion, dwell time and much more.

Port Throughput Indices - Apr 25

22 Apr: Our Global Container Port Throughput Index decreased 1.4% MoM in February, and at 116.5 points was up 8.8% YoY.

Hutchison's mega deal with BlackRock/TIL

07 Mar: Senior Associates, Eleanor Hadland and Eirik Hooper discuss the implications of the deal for the global container terminal industry.

Logistics Executive Briefing: Tariff Update

27 Feb: Possible penalties on China-built ships... US tariffs hit more countries... what next for shippers/BCOs?

Market insights and forecasts

Maritime Research

The leading independent voice in the market. Since 1970, senior stakeholders in shipping, maritime finance and logistics have relied on our robust analysis, balanced opinion and market forecasts. Project advisory services

Maritime Advisors

Whether to support business planning or investment decisions, complete commercial or technical due diligence, we bring know-how, rigour and objectivity to our opinions and recommendations. Ocean freight tender support

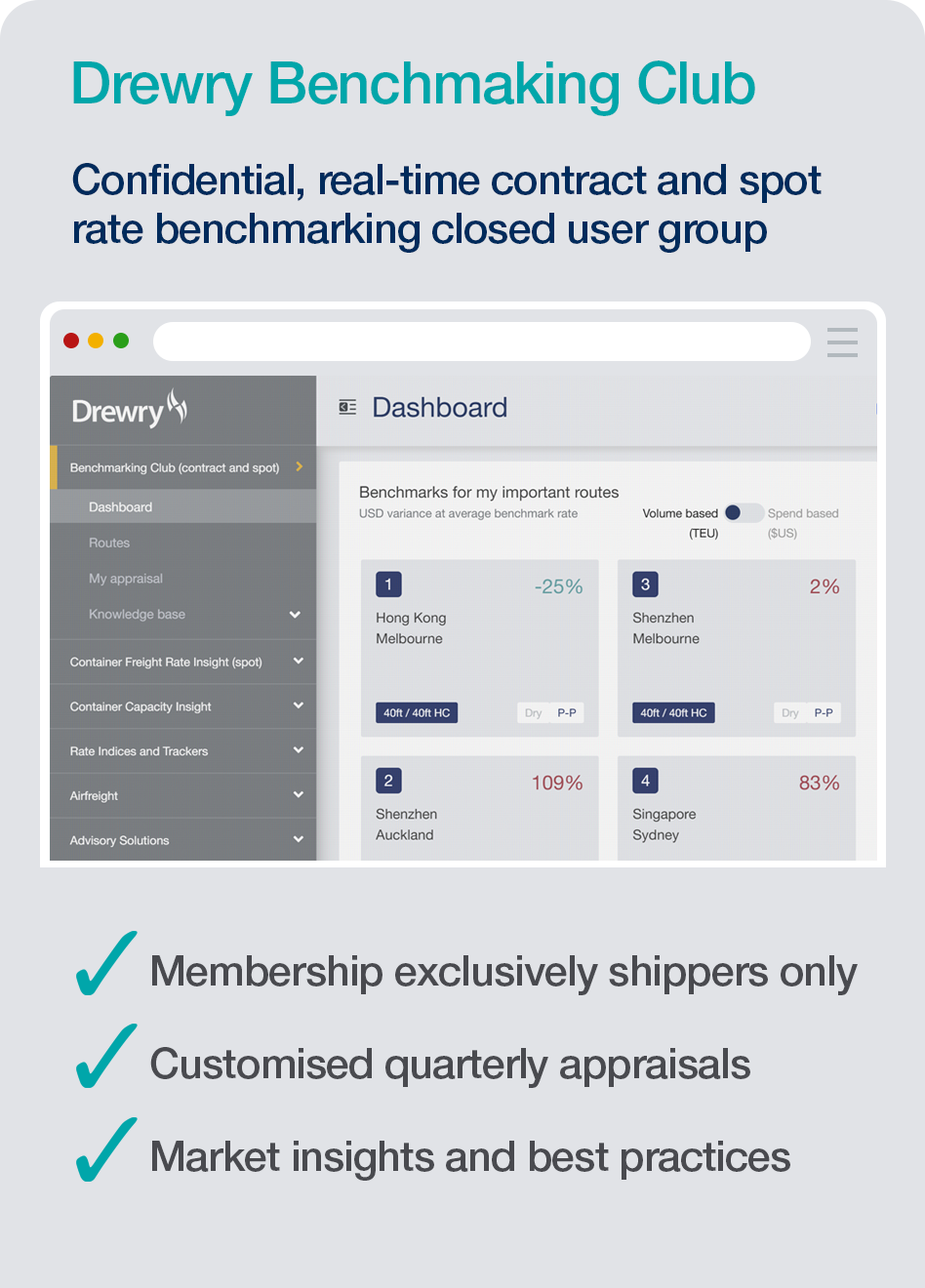

Supply Chain Advisors

We help some of the world's largest retailers and manufacturers benchmark their ocean freight costs and improve their ocean freight tender processes by combining robust market intelligence with powerful procurement technologies and proven best practices. Independent equity research

Maritime Financial Research

Our investment and financial research team is staffed by industry specialists, providing a truly independent financial and investment research service on companies in the maritime and shipping industry.Maritime Research

For robust market intelligence

Rigorous market analysis and balanced opinion for senior stakeholders in shipping, maritime finance and logistics.Maritime Advisors

For advice that delivers results

Combining in-depth sector understanding and specialist expertise to provide actionable advice that delivers a commercial edge.Supply Chain Advisors

For ocean freight procurement teams

Cutting edge technology, freight rate intelligence and tailored advice to support shippers through the ocean freight procurement process.Maritime Financial Research

For smarter investment decisions

Our investment and financial research team is staffed by industry specialists, providing a financial and investment research service on listed companies in the maritime and shipping industry.Drewry Research: 50 years charting the world's maritime markets

Find research by

All the main shipping sectors

From dry bulk to chemical, LNG to containers - we cover every shipping sector.

Combined intelligence

A unique combination of market-leading resources with in-depth sector understanding.

Trusted advisor

Objective and rigorous analysis have cemented our reputation as a trusted advisor.

Solutions for Shippers/BCOs

Popular Research Services

News

Events

Conferences

08 May 2025

ESPO Conference Thessaloniki 2025

Tim Power will be presenting the macro-economic outlook for ports.

Webinars

08 May 2025

Chemical shipping market outlook

Join us at 09:30 BST on Thursday, 8th May in a free webinar briefing that will summarise our latest research on the chemical shipping market.

© Copyright 2025 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy