Maritime Research

Intra-Asia Container Market Insight (Annual Subscription)

Online Service

December 2025

Market intelligence for intra-Asia trades

Drewry’s new Intra-Asia Container Market Insight is the first bilingual (English and Mandarin) market intelligence resource to help shippers, forwarders, carriers, port authorities and terminal operators keep up to date with the vast intra-Asian container shipping markets.

If your business interests extend into the intra-Asian container shipping markets, this new service will be an indispensable addition to your market intelligence portfolio.

Updated monthly, delivered digitally

Delivered through the Drewry OnDemand platform and updated monthly, it provides insights into trade route fundamentals, port performance and liner fleet strategies, both at the aggregate level as well as for each of the 15 sub-trade routes that connect the six key sub-regions: Greater China, North, South and Southeast Asia, the Middle East and Oceania. Please note that at present the service does not cover intra-China, intra-North Asia and intra-sub region container shipping.

Trade route analysis

Keep up to date with market development and fundamentals: supply, demand, vessel utilisation, freight rates and level of competition between service providers. The service leverages satellite data from our AIS feeds to provide accurate estimates for effective capacity per trade route. We complement this with trade route demand evolutions and a selection of freight rates drawn from our Container Freight Rate Insight service.

Carrier analysis

Discover who are the main carriers on each trade lane and evaluate their vessel deployment strategies to inform your competitive market assessment and vendor selection decisions.

Port performance analysis

The Port Analysis section provides essential port-related metrics. The Regional Port Throughput index, based on ’now-casted’ demand evolutions, provides a snapshot indication of the relative market strength. Port Call Performance analysis gives a good understanding of pre-berth waiting time and berthing time development at both sub-region as well as for the leading port in each sub-region.

Further information on the analysis within each main section:

- Summary section: highlights a particular issue or theme every month, comprising commentary and ’chart of the month’.

- 5 metrics for Trade Route Analysis: supply, demand, utilisation, freight rates, and HHI (for market concentration/competitiveness).

- Carrier Analysis metrics: market shares and capacity shares by trade route, floating capacity per operator.

- 5 regional Port Performance metrics for throughput, congestion, vessel calls by vessel size, port call performance and port productivity.

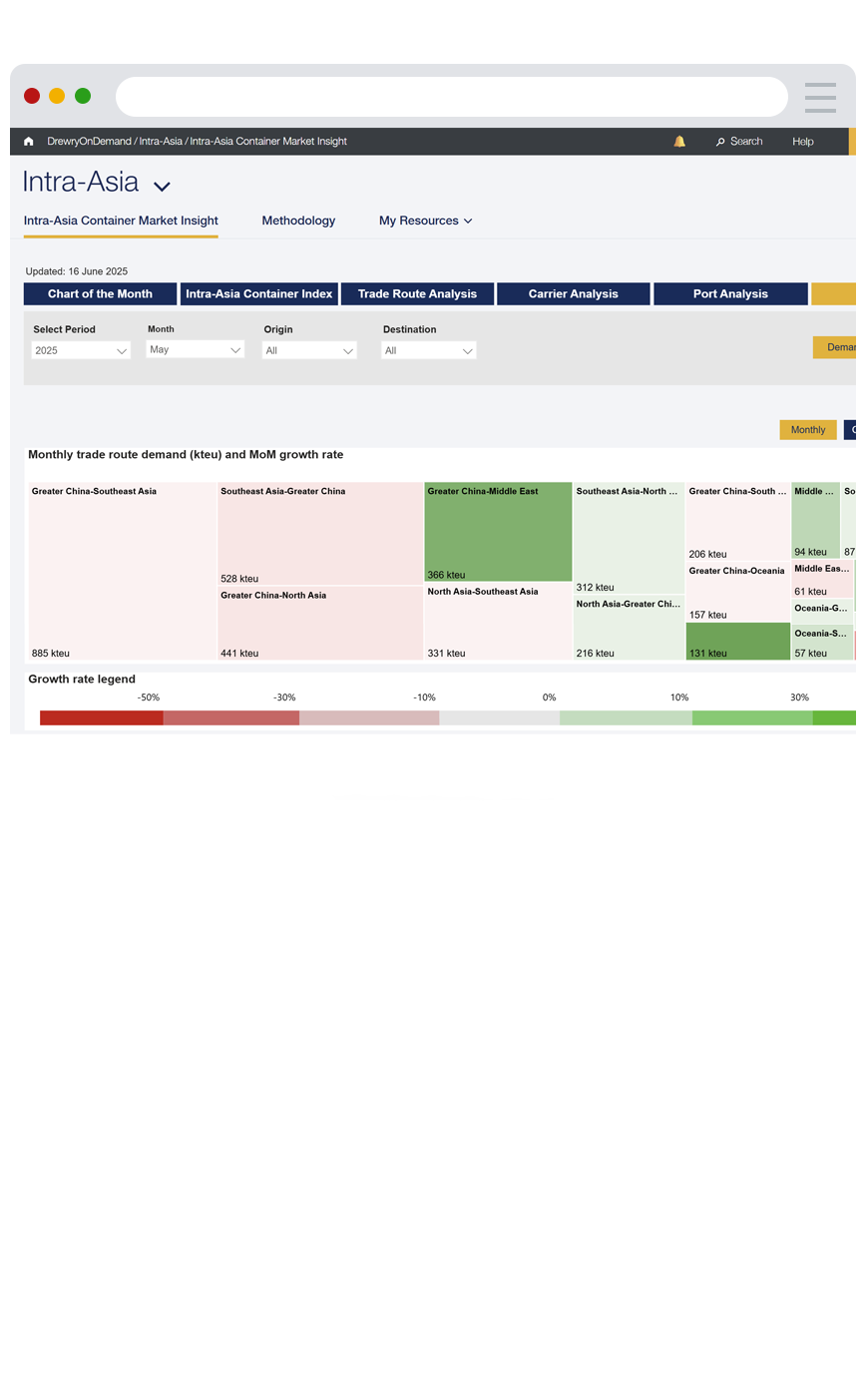

Regional heatmap for supply and demand

Providing a visual picture of supply and demand development across all intra-Asia trade routes. Monthly, quarterly and yearly visualisation.

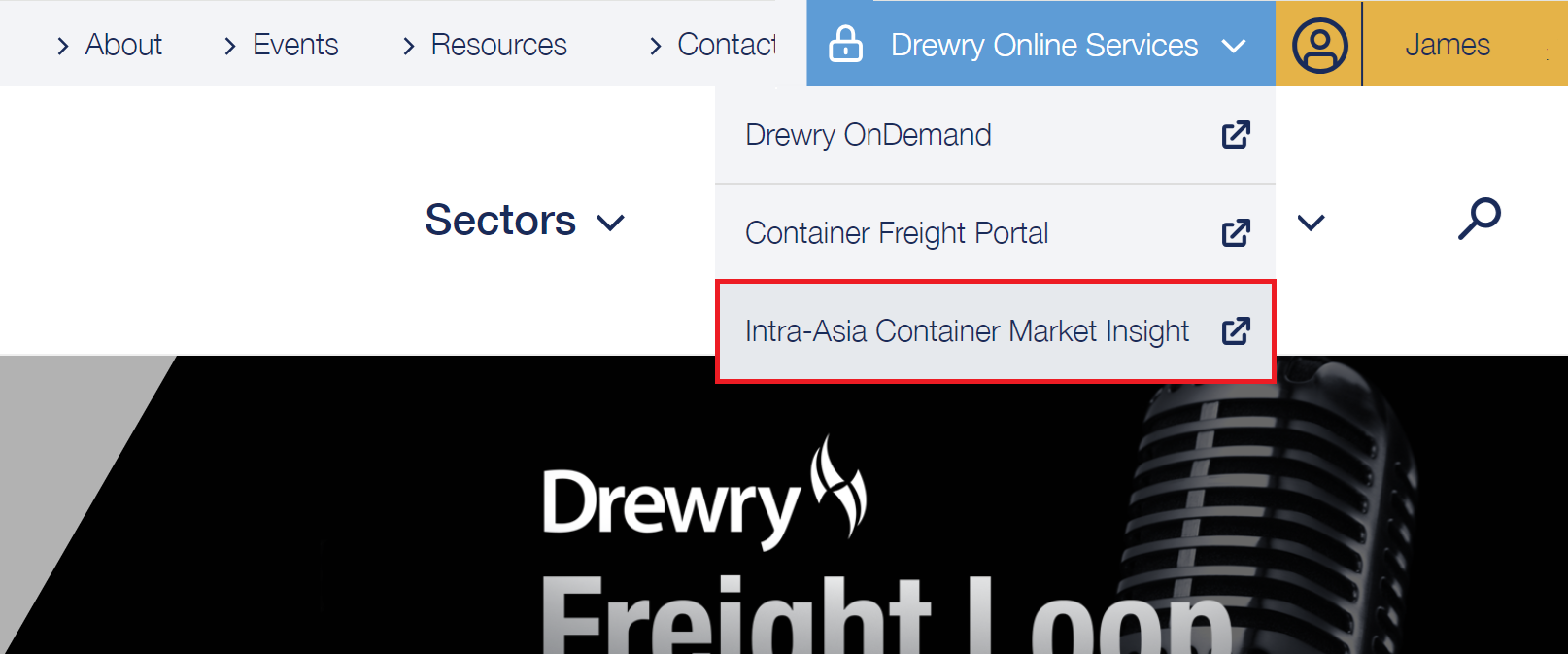

How to access the Intra-Asia Container Market Insight service

Access to this online subscription service is through the Drewry OnDemand platform.

More Information

Fast facts...

- Annual subscription (single-site licence)

- Monthly, online-only service accessed via Drewry OnDemand

- Trade routes fundamentals, liner strategies, port performance (monthly updates)

- Freight rates (fortnightly updates)

- Heatmap of trade route supply and demand development

- Historical time series from Jan 2019

- Download data from tables to Excel

News

© Copyright 2026 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy